At the end of 2025, Gartner surveyed 157 CFOs across many businesses and industries to identify the top 10 CFO focus areas for the years ahead. CFOs are hyper-focused on finance strategies, digital transformation, and the roadmap for their function. As finance evolves with “the future of finance” and “finance 3.0,” leaders have prioritized what they’ll need to succeed in today’s landscape. With these priorities in mind, strong foundational processes and systems are crucial, and corporate performance management (CPM) software is now vital to success.

The idea that FP&A’s role is the same as it was a decade ago is outdated and untrue. As FP&A takes on more strategic leadership in every organization, it needs the right tools to make an impact. Finding the best corporate performance management software is challenging because many options offer similar functionality. Instead of expecting finance leaders to sift through them all, we’ve compiled a list of the top corporate performance management tools on the market.

Our breakdown includes pricing, unique features, and expert opinions on each, so your finance team can focus on becoming tomorrow’s finance function. We’re looking at CPM solutions for small to medium-sized businesses with 100-500 employees, but most of these options can adapt to smaller or larger organizations.

What is Corporate Performance Management (CPM) Software?

People sometimes confuse CPM software with Enterprise Performance Management (EPM) software, which serves a broader, enterprise-level scope for monitoring performance. CPM software primarily helps finance teams track business performance, produce financial reports, and monitor KPIs.

These solutions typically include forecasting, budgeting, and automation capabilities. Finance teams report 90% fewer reporting errors and 85x faster processing times after implementing integrated CPM solutions. Because the industry is moving toward real-time visibility, most CPM software also supports sophisticated data visualization.

Key Features to Consider in a CPM Solution

Performance Monitoring and Reporting

Efficient performance monitoring and reporting form the backbone of any CPM software. These platforms give finance teams real-time insights into KPIs, which let decision-makers steer the business effectively. Look for solutions with customizable dashboards and scorecards tailored to your goals. Providers that specialize in business performance software typically offer cutting-edge tools for streamlined performance management.

Budgeting and Forecasting Capabilities

Robust budgeting and forecasting tools are essential for effective financial planning and decision-making. Pick CPM software with advanced capabilities for accurate forecasting and scenario planning. This helps you anticipate market changes, reduce risks, and optimize resources. Choose providers with financial performance management software to ensure precision and reliability in your financial processes.

Data Integration and Connectivity

Seamless data integration helps you gain actionable insights and make informed decisions. Your CPM software should connect easily through APIs and data connectors, ensuring it works with your existing systems. Look for providers that specialize in enterprise performance management solutions with robust data integration features, so you can unlock the full potential of your data.

Scalability and Flexibility

As your business grows, your CPM solution must adapt and scale. Look for corporate performance management platforms that adjust to your changing needs, whether you prefer cloud-based or on-premises deployment. Seek out vendors offering comprehensive CPM systems that can grow with you and deliver long-term value.

User-Friendly Interface and Accessibility

A user-friendly interface encourages productivity and adoption. Pick CPM software that’s easy to navigate and supports mobile access, so your team can work from anywhere. Providers that offer operational planning software can empower decision-makers with innovative tools for smooth planning.

Customer Support and Training

Reliable customer support and robust training resources make software adoption smoother. Choose vendors that prioritize customer satisfaction with detailed user manuals, tutorials, and training. Look for a proven track record of exceptional support to reduce implementation headaches and get the most from your CPM investment.

Benefits of Corporate Performance Management Software

When you have the right CPM software, you’ll access data easily, make critical decisions faster, and spend less time budgeting and more time on strategy. Here are some major benefits of CPM tools:

They shorten month-end close processes.

They deliver advanced analytics and insights.

They drive strategic conversations for leadership and FP&A teams.

They let you run scenario analyses to make better business decisions.

They automate time-consuming tasks.

To pick the best CPM software for your organization, check out the details below, explore a few solutions, and test two or three that look promising. Each section includes an “our rating” line item, which factors in platform availability, versatility, and customer reviews.

Best CPM Software choices in 2025

Here’s a quick snapshot of the top CPM tools we’ll compare, each offering unique strengths for different business sizes and requirements.

To be “best-in-class,” a CPM tool needs forecasting, budgeting, and ad-hoc analysis features, plus built-in visualizations. We also analyzed customer reviews to gauge service quality. Here are the best options for small-to-medium businesses in 2025.

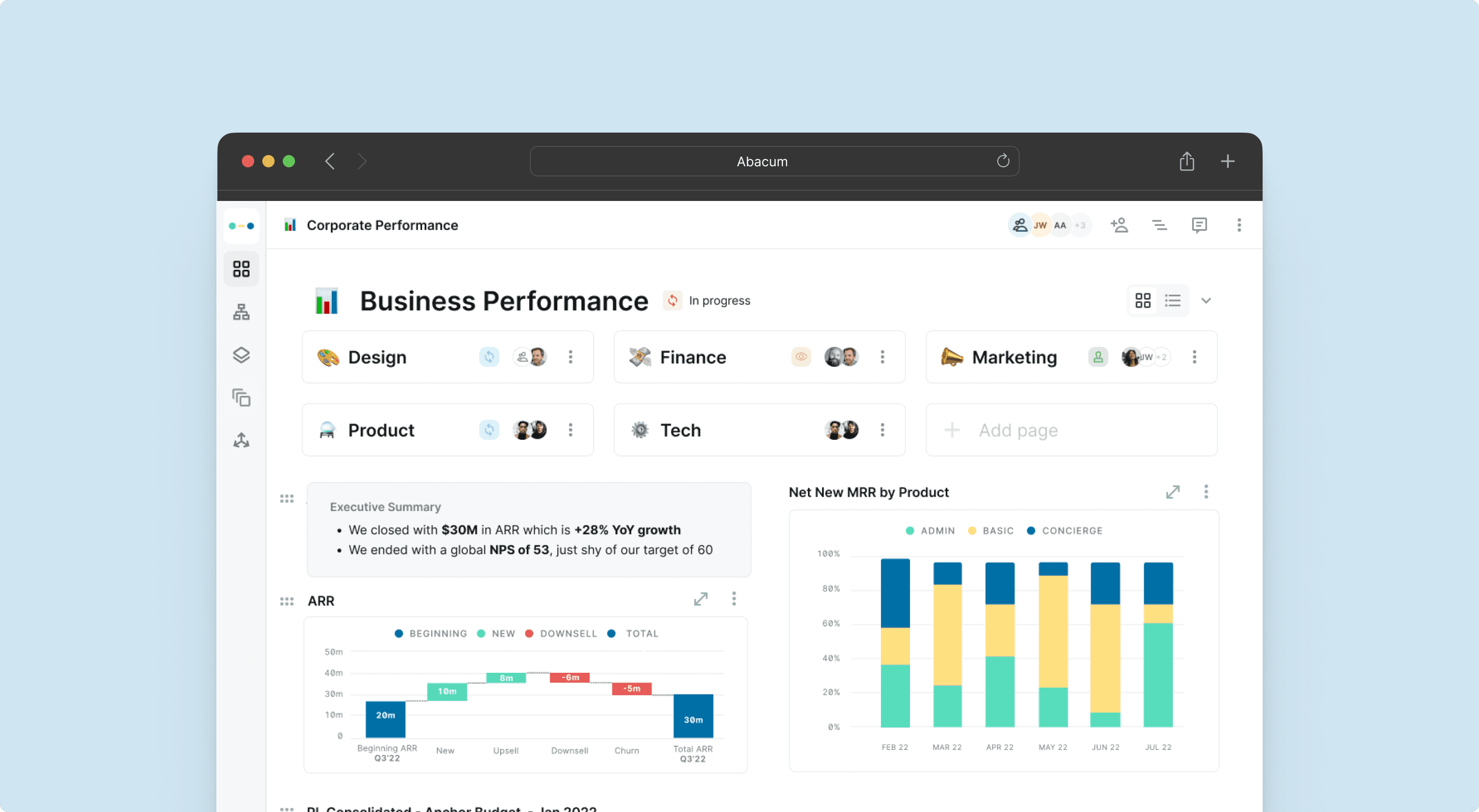

1. Abacum

Let’s take a closer look at what Abacum offers.

What Is Abacum?

Abacum is the FP&A automation platform that helps businesses drive efficient growth with ready-to-use CPM templates, faster revenue forecasts, scenario analyses, and budgeting workflows.

Its best-in-class integrations let FP&A teams connect all their business systems to automatically report and forecast financial, operational, and workforce metrics in a single platform.

Abacum lets you deliver ad-hoc insights in real time, automate budgeting workflows with custom permissions, and combine bottom-up or top-down forecasts with powerful multi-dimensional modeling. With accurate forecasting and stakeholder ownership, Abacum provides complete FP&A automation and saves businesses time and money every day.

Key Features of Abacum

Price: Abacum offers tailored plans based on your business needs.

Great for: Automating BvA reports, running ad-hoc analyses with built-in templates, leveraging multi-dimensional forecasting, and ensuring stakeholder accountability through custom workflows and vendor-level budgeting.

Advantages: Abacum has a longer integration partner list than many competitors and a dedicated customer service team. Its focus on ease of use ensures seamless stakeholder accountability and performance management.

Feature Highlight: Abacum includes an extensive library of visualization tools and off-the-shelf automation, making budgeting simple and forecasting quick.

Pros and Cons of Abacum

Pros: It’s user-friendly and offers real-time automation, robust modeling, and extensive integrations. Customers highlight its excellent support and time-saving features.

Cons: Currently, there’s no specific downside mentioned by users.

Our Rating: 5/5 stars

G2 Rating (January 2025): 4.8/5 stars

2. Oracle

(*There are several Oracle solutions to consider when choosing the right one for your needs, such as Oracle Cloud ERP, Essbase, and Planning Cloud. Research and evaluation can help you select the best solution to achieve your goals.)

One of the longest-standing corporate performance management tool providers, Oracle has a suite of products that can be used in conjunction with one another and with other business systems.

This brand is a household name for large, enterprise organizations, which is why Oracle’s CPM software may not be suited for small and medium-sized businesses.

Price: Cost only available via custom quote.

Great for: Enterprise organizations that need a robust system can depend on Oracle to deliver.

Advantages: Many organizations use some combination of Oracle products, enabling businesses to leverage the advantages of working with one single vendor.

Feature Highlight: The multi-module system allows you to connect many different systems and data sources into one, making this a great option for larger organizations with multiple locations, subsidiaries, and complex business lines.

Customer Complaints: For users unfamiliar with Oracle, there can be a steep learning curve to effectively use these corporate performance management tools. The implementation timeline can also last between 8-12 months, delaying the time-to-value for FP&A teams.

Our Rating: 3.8/5 stars

G2 Rating (January 2025): 4.3/5 Stars

3. SAP

(*There are several SAP solutions to consider when choosing the right one for your CPM needs, such as SAP Analytics Cloud, Business Planning, and Consolidation. Research and evaluation can help you select the best solution to achieve your goals.)

SAP corporate resource management tools work together seamlessly with one another and have the power of a household name behind them. The SAP Analytics Cloud and related CPM tools allow you to partner with other functions, model multiple scenarios and test cases, and run your financial planning processes. With a wide-reaching community of users, SAP forums are collaborative and helpful spaces, offering many ways to resolve issues and troubleshoot challenges.

Price: Business plan starts at $21 per user/month.

Great for: Organizations that already use other SAP legacy products and have standardized their data to SAP’s suite of products.

Advantages: SAP works with and supports enterprise businesses, making its solutions great for multi-corporate organizations.

Feature Highlight: The reporting features provide standard business KPIs in a single dashboard.

Customer Complaints: Some common customer complaints are that complex data drill down requirements are challenging with SAP Analytics Cloud. As well as the product offers limited data preparation features making it difficult to integrate different business systems

Our Rating: 4/5 Stars

G2 Rating (January 2025): 4.4/5 Stars

Learn more: 6 SaaS FP&A-focused ideas to assist finance leaders in scaling their teams

4. Anaplan

Users commend Anaplan’s thoughtful user interface and ability to navigate complex data sets in an analytical capacity. Anaplan serves customers at the enterprise level, with 90% of its customer base falling within that segment.

This CPM tool can be relied on for quintessential finance functions like the close process, financial consolidation, compliance audits, and analytics. It offers dashboard functionality as well as PDF reporting for leaders who may struggle with high-tech features.

Price: Cost only available via custom quote.

Great for: Finance professionals that work in enterprise or publicly listed organizations, and are not required to produce ad-hoc analysis frequently.

Advantages: Anaplan’s versatility allows it to span beyond finance into supply chain and other functions, providing a high value to the enterprise businesses it serves.

Feature Highlight: With access to multi-dimensional scenario testing, Anaplan users can forecast and plan their business activities in a single platform. Regular financial spreadsheets can be created and saved for future use.

Customer Complaints: Some customers mentioned that Anaplan requires having a dedicated in-house team in order to leverage the platform. Performing custom changes within Anaplan requires technical coding skills, this can create time-sensitive obstacles during planning periods.

Our Rating: 4.5/5 Stars

G2 Rating (January 2025): 4.6/5 Stars

5. Workday Adaptive Planning

Probably more of an enterprise planning management software than solely a corporate performance management tool, Workday Adaptive Planning boosts data analysis and decision-making across finance, sales, human resources, and other functions.

It connects with any ERP, GL, or other spreadsheets to create insights, automate forecasts, and output management reports. Since it can be used across functions, it’s incredibly robust and ready to take on any challenge.

Price: Cost only available via custom quote.

Great for: Medium and large enterprises that are looking for one tool to use in a variety of functions and settings. Absorbing the level of data that Workday Adaptive Planning does isn’t something that many other applications can handle.

Advantages: This CPM software has the most readily available cross-functional capabilities, positioning finance teams as a strategic business function with ease. Scaling sustainably is an art form that is made easier with Workday.

Feature Highlight: Workforce management and labor metrics do not happen separately from finance; Workday is one of the first tools to see it that way and integrate employee information with financial data, driving valuable HR and finance insights simultaneously.

Customer Complaints: Though customers appreciate the many ways this application can be used, they struggle with its slow calculation speed and lack of customizable. functionalities. Many organizations have one-off data inputs that happen irregularly or need to be manually added, and Workday isn’t compatible with those requirements.

Our Rating: 4.2/5 Stars

G2 Rating (January 2025): 4.3/5 Stars

6. IBM Planning Analytics

Bringing together the infrastructure of a financial database and the user interface of Excel, IBM Planning Analytics is a CPM software that most finance organizations find very easy to learn and adopt.

Meant to democratize data, IBM’s corporate performance management tool is widely used and well-liked by many enterprise organizations.

Price: Cost only available via custom quote.

Great for: Finance organizations that are ready to take their analytical capabilities to the next level but don’t want to struggle with change management and adoption. IBM Planning Analytics uses a Microsoft Excel interface, making it easy for any finance professional to start benefiting from its features. From simple spreadsheets to complex workflows, IBM can do it all.

Advantages: IBM PA can reconcile data from different sources, highlight discrepancies, and even provide information as to where discrepancies are coming from. Any organization with multiple data sources knows how much of a headache data discrepancies can be, but with IBM PA, the process is optimized.

Feature Highlight: Drag and drop analysis makes it easy for finance teams to conduct detailed analytical investigations without complex modeling.

Customer Complaints: Customers do not feel supported in mastering and adopting the solution, citing a lack of customer service from IBM.

Our Rating: 3.8/5 Stars

G2 Rating (January 2025): 4.4/5 Stars

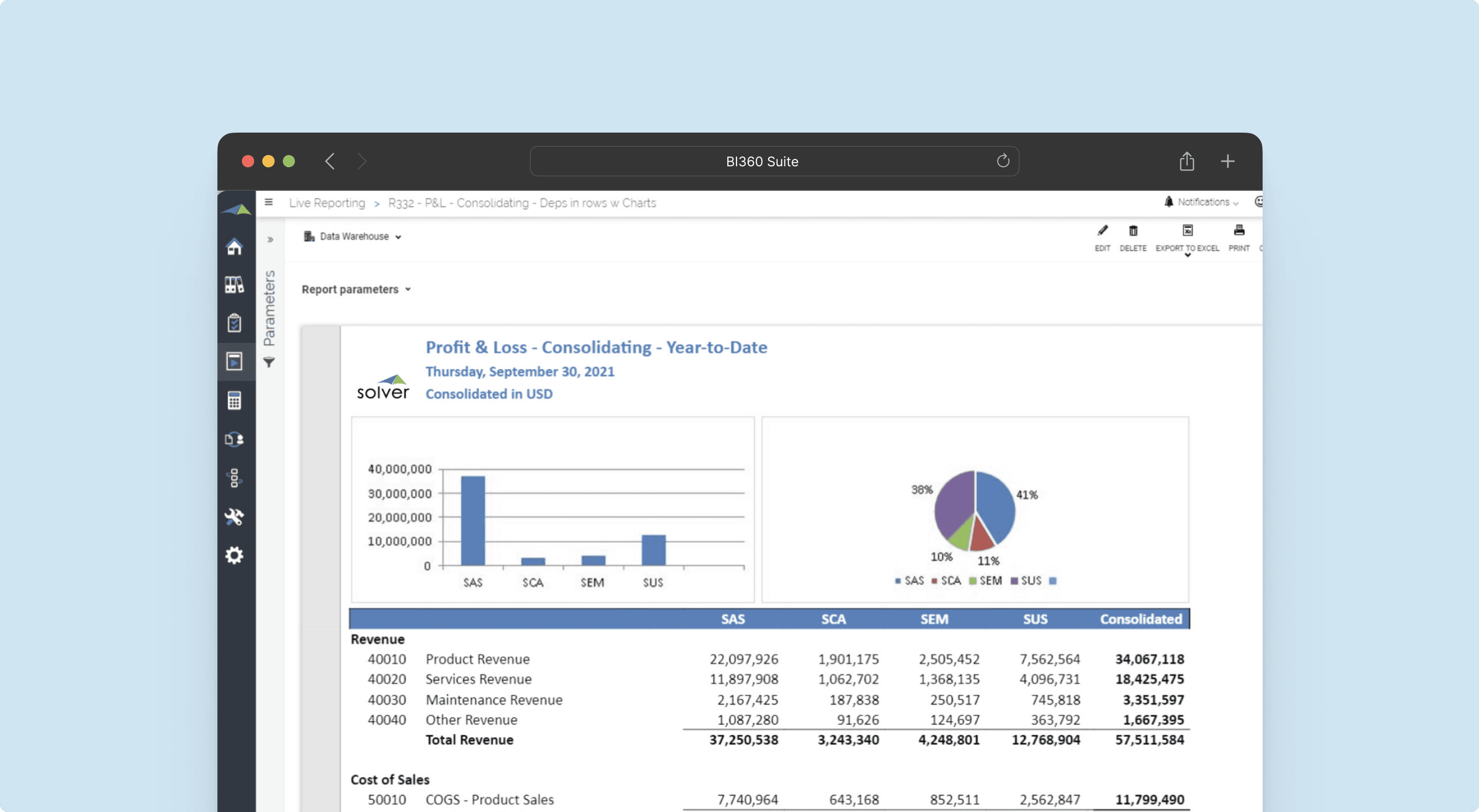

7. Solver

Solver’s BI360 is a business intelligence (BI) software solution that combines the features of Microsoft Excel with a data warehouse and a modern web portal. This easy-to-use application enables simple and complex financial performance reporting while keeping the user interface intuitive. It seamlessly integrates with multiple ERP systems and its own data warehouse, ensuring flexibility for its customers.

Price: Base licensing cost starts at $312 per user/month.

Great for: Non-technical users that are looking to benefit from powerful reports and insights with a few clicks of a button.

Advantages: Solver’s key features offer easy system integrations with current systems, can be used by non-technical employees, and offers all the reporting features of Power BI due to its links with the platform.

Feature Highlight: Because of its link to Power BI, this product enables cash flow simulations using interactive sliders, illustrating the relationship between cash flow and business performance.

Customer Complaints: Customers have struggled to resolve specific issues with Solver’s customer support team. Sometimes, the team is unable to replicate the issue and other times a solution is not available.

Our Rating: 3.5/5 Stars

G2 Rating (January 2025): 4.5/5 Stars

8. OneStream Software

With one of the only truly customizable platforms in the CPM software industry, OneStream allows its users to build new solutions directly within its platform. It maintains a single source of truth while providing as much flexibility as possible, which is a challenging combination to perfect in today’s digital landscape. When data is ready to be processed, OneStream offers AI and machine learning tools to take that data to the next level.

Price: Cost only available via custom quote.

Great for: Growing organizations that have at least a base level of expertise with VB coding and more advanced languages.

Advantages: Financial close timelines can be greatly reduced with OneStream while maintaining industry-standard data security measures. Budgeting, annual planning, and data visualization are all key features of this financial management system.

Feature Highlight: With a built-in financial intelligence library, OneStream effortlessly processes multiple currencies, account ownership, and intercompany activities. In even the most advanced financial organizations, these items can be a source of massive challenges, and OneStream can help optimize those challenges without any outside input.

Customer Complaints: It’s not a solution that can work for no-code finance professionals, and due to its newness, the support infrastructure isn’t as strong as other, larger corporate planning management tools.

Our Rating: 3.6/5 Stars

G2 Rating (January 2025): 4.6/5 Stars

9. Vena

As a corporate performance management software, Vena uses an Excel interface and a proprietary growth engine to help its customers grow to their full potential. This cloud-based CMP tool brings together multiple data sources and easily integrates with existing systems to boost your organization’s functionality with very little effort on your part. You won’t need to provide complex training classes or hold the hands of your employees as they adopt Vena; it’s built to be used with existing finance skill sets.

Price: Cost only available via custom quote.

Great for: Organizations that aren’t ready to abandon Excel or completely revamp their finance talent pools can use this planning software. With Vena, up-leveling the finance function is as intuitive as a classic monthly forecast process.

Advantages: With Vena, team collaboration is easy. Multiple people can work in the same financial statements while still protecting from errors with document locking or cell freezing.

Feature Highlight: Vena’s long list of data integrations makes it easy for your organization to enjoy a single source of truth without overhauling your data landscape.

Customer Complaints: To access some of the more complex features Vena offers, a more advanced technical skill set is necessary. However, customers also mention that the Vena support team is quick to respond and helpful in resolving any issues.

Our Rating: 4/5 Stars

G2 Rating (January 2025): 4.6/5 Stars

CPM Software for Your Business Needs

After conducting a thorough comparison of various Corporate Performance Management (CPM) software options available in the market, it’s clear that businesses have a variety of choices to streamline their financial processes and enhance performance management. Each CPM tool offers its unique features, pricing structures, and advantages, catering to a range of business needs and preferences.

From established names like Oracle and SAP to emerging players like Abacum and Workday Adaptive Planning, there’s a CPM solution suitable for organizations of different sizes and industries. Factors such as integration capabilities, user interface, scalability, and customer support are crucial considerations when selecting the right CPM software for your business.

Three Actions to Take from Here:

Explore Further: Dive deeper into understanding how CPM software can revolutionize your finance function and drive business growth. Read comprehensive guides and resources provided by leading CPM solution providers like Abacum. These resources can offer insights into best practices, case studies, and tips for maximizing the benefits of CPM tools.

Schedule Demos or Consultations: Take advantage of the opportunity to schedule demos or consultations with CPM software vendors. This allows you to gain firsthand experience with the platforms, ask questions specific to your business needs, and evaluate how well each solution aligns with your objectives. Reach out to vendors like Abacum to book a personalized session and explore how their CPM solution can address your challenges effectively.

Evaluate Your Current Processes: Reflect on your current financial processes and performance management strategies. Identify pain points, inefficiencies, and areas for improvement within your organization. Use the insights gained from the CPM software comparison to pinpoint which features and functionalities are essential for enhancing your workflow and achieving your goals. Whether it’s improving budgeting accuracy, accelerating month-end close processes, or gaining real-time insights, align your priorities with the capabilities offered by top CPM solutions.

By taking these actions, you can empower your organization to make informed decisions about implementing the best CPM software solution tailored to your needs, driving greater efficiency, agility, and success in financial management and performance optimization.

Which CPM Tool is Best for You?

Choosing the right CPM tool depends on your organization’s size, budget, and workflows. Smaller companies may want user-friendly solutions with quick implementation, while larger enterprises might prioritize advanced analytics and broad integrations. Consider your data complexity, reporting frequency, and stakeholder needs before making a final call.

Conclusion: Abacum, The Ultimate Business Performance Management Software Solution

Designed with mid-size companies in mind, Abacum’s software is a cut above the rest.

If you’re still not sure which CPM tool to go with, Abacum is the perfect solution. It is the leading CPM platform for mid-market companies and its award winning in-house FP&A team delivers the fastest onboarding in the market.

Here are the top 5 reasons we know you’ll love it:

Equipped with an in-house implementation team, you’ll never feel like you’re navigating uncharted waters without support.

It’s logical and intuitive. Other tools often require coding experience and a technical background, but Abacum works for everyone.

Its UX and UI are unmatched, boosting adoption rates and shortening ROI timelines.

Our automation, data integration, and built-in reconciliation save your team from chasing numbers or #REF errors.

We let our product speak for itself, and we won’t drag out the sales cycle.

We know you’ll love it. Reach out to us for a demo or informational call today!