As 2026 approaches, agile budgeting is essential for businesses aiming to stay competitive. Manual spreadsheets slow teams down and introduce costly errors (94% of them contain critical mistakes).

This guide explores the top budgeting software to help FP&A teams streamline processes, reduce risks, and make faster, smarter decisions.

We compare leading tools, highlight key features, and share a budgeting template to support companies of all sizes. With the financial management software market set to grow to $24.4 billion by 2025, automation and cloud-based platforms are becoming indispensable. From real-time reporting to AI-driven insights, adopting modern solutions enables finance teams to cut errors, save time, and focus on deeper analysis.

Key Takeaways from this Article |

|---|

|

What is a Business Budgeting Software?

Business budgeting software automates the budgeting process, improving efficiency and accuracy while reducing the workload on finance teams and employees.

Approximately 90% of spreadsheets contain errors, making Excel-based budget management highly error-prone.

To address this risk, companies are turning to business budgeting software. These tools are replacing the status quo of Excel spreadsheets, Google Sheets templates, and lengthy meetings where few truly understand the spreadsheet. Modern solutions streamline all financial planning workflows.

Business planning software tools are invaluable for Financial Planning and Analysis (FP&A) departments looking to plan, forecast, and manage company finances. These solutions range from simple dashboards to advanced budgeting tools capable of automating financial reporting and generating statements like profit and loss statements, balance sheets, and cash flow reports.

While many competitor articles focus on basic definitions and surface-level user interfaces, a truly comprehensive business budgeting software stands out by offering strong data integration, advanced analytics, and proven performance benchmarks.

Leading corporate budgeting solutions typically provide real-time dashboards, customizable templates, and collaboration features that unify finance teams and departmental stakeholders. These systems often go beyond simple expense tracking or revenue forecasting, incorporating advanced allocation methods, scenario planning, and centralized data management.

By comparing these competitor insights, businesses can better understand the technical capabilities and operational benefits that set top-tier budgeting software apart from standard, spreadsheet-based processes.

5 Benefits of a Budgeting Software for All Business Sizes

The primary goal of any budgeting tool is to save time and help businesses successfully deliver their annual budget. Implementing budgeting software offers several benefits to FP&A teams, including:

Planning and forecasting budgets across the entire organization.

Shaping business strategy and decision-making with financial data and operational insights.

Managing cash flow and operations effectively.

Improving transparency and collaboration in financial planning with budget owners.

Staying on track with financial goals.

Did you know that… A survey revealed that 50% of small businesses operated without formal budgets in 2020, while 54% increased budgets in 2021 anticipating post-pandemic recovery.

How a budgeting software benefits enterprise-level businesses

Enterprise-level businesses benefit from budgeting software by enabling seamless planning and forecasting across departments and subsidiaries. These platforms integrate real-time reporting for informed decision-making and streamline cash flow management, boosting collaboration company-wide.

How a budgeting software benefits corporate businesses

Corporate businesses use budgeting software to centralize budgeting processes and automate tasks. The software provides visibility into financial health and variance reporting, empowering decision-makers with actionable insights.

How to choose the right budgeting software for a mid-market company

Budgeting needs in the mid-market are unique — more complex than startups, but without the resources of large enterprises. That’s where the choice of software becomes critical:

Spreadsheet-based tools: Familiar, but still heavily manual. Collaboration is clunky, data refreshes are slow, and scaling beyond a few cost centers becomes unmanageable.

Enterprise tools: Feature-rich but overwhelming. They require consultants, long implementations, and full-time admins — often too heavy and costly for mid-market finance teams.

Lightweight platforms: Quick to deploy, but rigid. They lack advanced workflows, multi-entity consolidation, and true collaboration with budget owners.

Abacum is purpose-built for the mid-market:

End-to-end budgeting workflows with approvals, notifications, and status tracking.

Collaborative planning that gets budget owners and non-finance stakeholders engaged.

Best-in-class integrations with ERPs, HRIS, and billing systems to centralize data.

Enterprise-level modeling (dimensions, scenario planning, versioning) — without enterprise cost or complexity.

Fast time-to-value: implementation in weeks, not quarters.

How a budgeting software helps small businesses

For small businesses, budgeting software simplifies budget creation, expense tracking, and forecasting. These platforms offer user-friendly interfaces and affordability, optimizing financial performance for long-term sustainability.

Types of Business Budgeting Methods

Businesses can choose from several budgeting methods to allocate resources effectively. Below are some common approaches:

Top-down budgeting

In top-down budgeting, leadership sets overall financial targets and allocates budgets to departments or teams. Each department then decides how to best use those funds to achieve their objectives.

Bottom-up budgeting

Bottom-up budgeting starts at the departmental or team level. Each group proposes its budget needs, which are then consolidated to form the company's overall budget.

Zero-based budgeting

Zero-based budgeting requires teams to build their budgets from scratch for each new period, justifying every expense rather than adjusting previous budgets.

Incremental budgeting

In incremental budgeting, the current budget serves as the baseline, and small adjustments are made based on factors like inflation, new projects, or growth targets.

Key Features of a Good Business Budgeting Software

When evaluating budgeting software, certain core features are non-negotiable for modern finance teams. These capabilities transform budgeting from a static, annual exercise into a dynamic, strategic function.

Integrations and data consolidation

Effective budgeting software must connect with your existing tech stack. Look for tools that offer seamless integrations with ERP, CRM, and HRIS systems to create a single source of truth for all financial and operational data.

Automation and AI-powered workflows

Automation eliminates tedious manual tasks like data entry and report generation. This frees up your finance team to focus on strategic analysis. Some platforms also use AI to detect anomalies and improve forecast accuracy.

Forecasting and scenario planning

The ability to look ahead is critical. Top software includes tools for creating rolling forecasts, running what-if analyses, and modeling different scenarios. This helps your business stay agile and respond to market changes.

Collaboration and approval workflows

Budgeting is a team sport. A good platform provides features for stakeholders to collaborate in real-time. It should also include structured approval workflows to streamline reviews from department heads to the executive team.

Features to Consider based on your Business Size

Choosing the right budgeting software is crucial for businesses of all sizes, but priorities can differ depending on the scale of operations. Whether you're a large enterprise, a mid-sized company, or a small business, it's important to carefully weigh different factors. Below, you'll find the essential criteria to evaluate when looking at a budgeting platform, categorized by business size.

When comparing the best business budgeting tools on the market, match their features to your organizational needs. High-performing platforms usually highlight multi-scenario planning, real-time financial dashboards, and automated data imports from accounting or ERP systems.

Many also include workforce management, rolling forecasts, robust variance analysis, and built-in corporate budgeting templates. By aligning these features with your business model, you'll find a solution that improves accuracy, encourages collaboration, and outperforms simple spreadsheets or less-specialized alternatives.

At the enterprise and corporate level

For larger enterprises and corporations, scalability, customization, integration capabilities, advanced reporting, analytics, and strong security are top priorities. The chosen software should handle large volumes of data, integrate with existing systems, and offer sophisticated reporting while ensuring data security and compliance.

At mid-sized businesses

Mid-sized businesses need software that balances functionality with affordability. Ease of use, cost-effectiveness, collaboration tools, and scalability are key. The system should feature a friendly interface, flexible pricing, real-time collaboration options, and room to grow as the business expands.

At small businesses

Small businesses typically stress affordability, accessibility, basic financial management features, and responsive support. Cloud-based accessibility, straightforward financial tools, and reliable customer service are essential. The software should provide budget creation, expense tracking, and cash flow management without breaking the bank.

Business budgeting software not only streamlines financial management and budget variance reporting, but also helps FP&A teams uncover cost-saving opportunities.

Most platforms offer features like income and expense tracking, report generation, budget creation and management, and financial forecasting. With these capabilities, businesses of any size can gain more control over finances and make data-driven decisions to drive growth.

How to Create Departmental Budgets with Corporate-Level Roll-Ups

Consolidating departmental budgets into a single corporate overview is often a major pain point for finance teams. Manual roll-ups in spreadsheets are time-consuming and highly susceptible to errors.

Budgeting software solves this by providing a unified workspace for the entire organization. Department heads can build and submit their budgets directly within the platform using predefined templates.

The system then automatically aggregates this data in real-time. This creates an accurate, consolidated corporate budget without manual intervention. Finance teams can instantly see the complete financial picture and drill down into departmental details as needed.

How to Involve the Executive Team in Budget Reviews with Software

Getting executive buy-in is crucial for a successful budgeting process. However, leadership teams need high-level insights, not complex spreadsheets filled with raw data.

Modern budgeting software makes this easy by offering customizable, real-time dashboards. These visual reports highlight key performance indicators (KPIs), budget-to-actual variances, and other critical metrics. This gives executives a clear, at-a-glance view of the company's financial health.

Furthermore, features like built-in approval workflows and commenting tools streamline the review cycle. Executives can ask questions, provide feedback, and approve budgets directly within the platform. This creates an efficient process and a clear audit trail for all decisions.

10 Best Business Budgeting Software Tools

1. Abacum

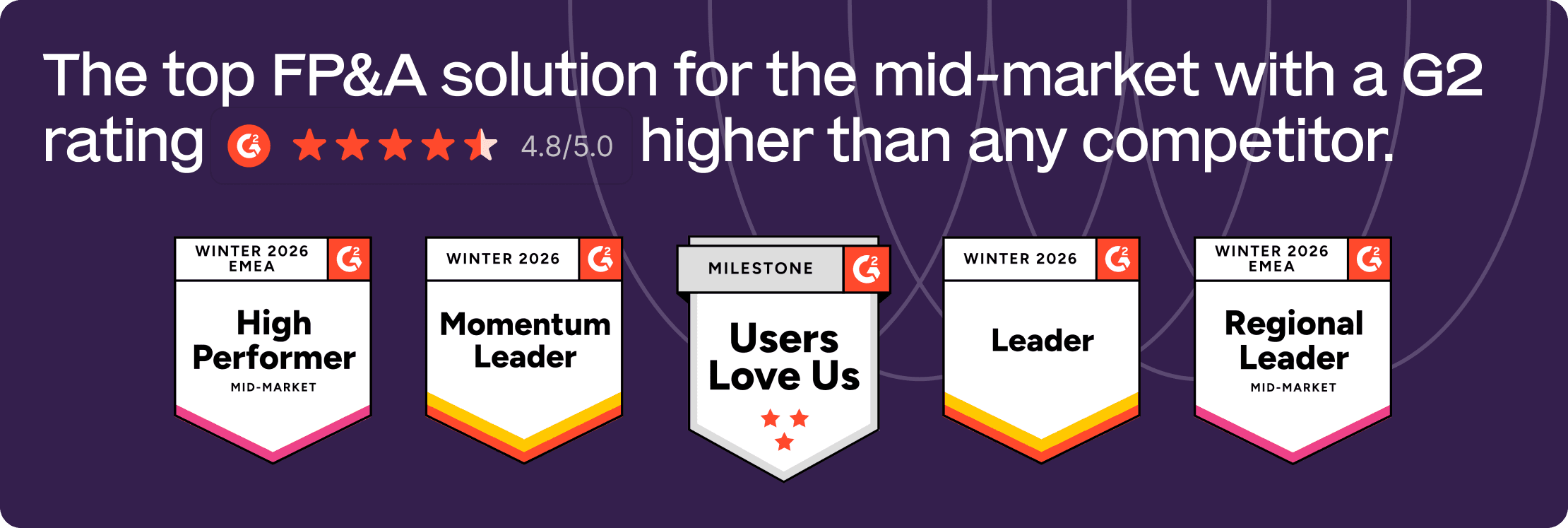

Abacum is revolutionizing the field of corporate business performance and budgeting software tools with its extensive integration capabilities (ERP, CRM, HRIS) and intuitive visualization interface.

By simplifying decision-making processes, Abacum empowers businesses to effortlessly share insights, automate budgeting workflows and tasks, streamline leadership approvals, and merge bottom-up and top-down forecasts or budgets. With quicker access to insights and enhanced analytics, Abacum automates core budgeting processes and consistently delivers tangible value to its users.

Abacum provides unique benefits compared to ERP systems by offering budgeting add-ons and serving as a centralized platform for the entire organization’s data. By integrating with HRIS for people planning and CRM for sales capacity models, Abacum acts as the single source of truth, enabling comprehensive insights and analysis for financial planning and forecasting.

Business Software Size: Mid-size and Enterprise level solution

Price: Tailored pricing plans are based on unique business requirements.

Great for: Mid-market companies looking for a best-in-class budgeting solution. With its flexibility, Abacum can tailor to the needs of a wide range of business industries.

Advantages: Abacum can help FP&A teams drive an efficient budgeting cycle with faster revenue forecasts, vendor level budgeting, and headcount planning capabilities.

Feature Highlight: Structured budgeting workflows that make driving budget owner accountability seamless with custom roles, budget approvals, and core collaboration functionalities.

Lowlight: None reported.

G2 Rating: 4.8/5

Book a 20-min call with our team to know more!

2. Prophix

Prophix is a financial planning and analysis software that empowers organizations to streamline their budgeting, planning, and forecasting processes. Prophix offers a user-friendly interface and robust functionality that helps enterprise businesses eliminate manual spreadsheet-based processes, reduce errors, and enhance collaboration across departments.

Business Software Size: Enterprise level solution

Price: Cost only available via a custom quote.

Great for: Finance teams at large enterprises.

Advantages: Its integration coverage and the flexibility it provides to create dimensions, mappings cover the enterprise business needs for strategic planning.

Feature Highlight: Budgeting features like the Detailed Planning Manager, which allows users to easily budget at different levels.

Lowlight: Though customers appreciate the budgeting features, limited dashboard functionalities, and platform speed make it challenging to present final budget figures across the business.

3. Planguru

Planguru is a forecasting and budgeting software solution that targets small and medium-sized businesses as well as nonprofits. They provide a simple solution for budget planning and forecasting.

Business Software Size: Small and medium sized businesses.

Price: Planguru offers 2 pricing plans:

Single-entity, which starts at $99/month.

Multi-department consolidation starts at $299/month.

Great for: SMBs with simple budgeting processes and forecasting methods, that are using Xero or Quickbooks online as an ERP.

Advantages: Planguru perfectly covers the business needs of SMB customers.

Feature Highlight: Customers appreciate the ability to consolidate multiple divisions, as well as the forecasting analytics and rolling forecast features. The direct integrations with Quickbooks Online and Xero support the data needs of small-sized businesses.

Lowlight: Customers comment that some of the features are only available in the desktop version and not in the cloud-based version of Planguru. This limitation hinders FP&A teams in their collaboration with budget owners.

4. Budgyt

Budgyt is an FP&A solution with the selling point of simplifying budgeting, forecasting, and performance management for small business owners and their businesses.

Business Software Size: Small businesses.

Price: They offer four pricing plans that depend on the number of budgeting departments each business has.

They also offer custom pricing options for non-profit and for-profit businesses:

Easy, $399/year for 10 budgeting departments.

Plus, $699/year for 25 budgeting departments.

Pro, $999/year for 50 budgeting departments.

Enterprise, upon request.

Great for: SMBs that already have a well defined budgeting process in which the number of departments will stay consistent.

Advantages: A simple and intuitive interface that simplifies the reporting, budgeting, and forecasting workflows.

Feature Highlight: Users appreciate the role-based users permissions.

Lowlight: Customers have struggled with the lack of customizable reports and limited people planning capabilities.

5. Sage

While at its core Sage is a provider of accounting software, it also offers business budgeting capabilities with its Sage Intacct Planning features. This means Sage has the potential of being the single accounting and budgeting platform for enterprise customers, as it supports project management, bookkeeping, expense management and cash flow forecasting functionalities.

Business Software Size: Small and medium sized businesses.

Price: Price upon request.

Great for: Sage as a business budgeting software is best suited for businesses that are already using Sage as their accounting provider.

Advantages: The versatility of being both an accounting tool as well as a budgeting solution, supporting the FP&A needs of enterprise customers.

Feature Highlight: Customers appreciate the scenario capabilities and the ability of being able to export financial reports and dashboards into PDFs.

Lowlight: The UI is limited and not very customizable, making budget owner adoption challenging within its customer base.

6. Microsoft Dynamics

Microsoft Dynamics is Microsoft’s effort to address the ERP and CRM market. While these are their main value propositions from which they acquire the majority of their customers, they also provide plenty of different modules to manage diverse aspects of business processes like finance, sales or marketing.

Its budgeting tool, Microsoft Dynamics Finance enables businesses to effectively manage their finances. With real-time visibility, seamless integrations, and advanced forecasting capabilities, Microsoft Dynamics can help FP&A teams streamline the budgeting process, enhance accuracy, and promote collaboration across departments.

Business Software Size: Enterprise level businesses.

Price: Microsoft Dynamics offers two pricing packages:

Business Central Essentials, which costs $70/month per user.

Business Central Premium, which costs $100/month per user.

Great for: Enterprise customers that are already well connected with the Microsoft suite of products.

Advantages: Microsoft Dynamics provides standard modules that cover the budgeting needs of most enterprise businesses.

Feature Highlight: Flexible budgeting scenarios, automated calculations, and real-time updates, empowering finance teams to make informed decisions and adapt company budgets as needed.

Lowlight: Customers comment on both the cloud and mobile version of the application having slow response times and frequent development issues. The lack of core collaboration features is also highlighted by customers who use Microsoft Dynamics for its people planning capabilities.

7. QuickBooks Online

QuickBooks Online is a cloud-based accounting software designed for small businesses and self-employed individuals. It offers a range of features that simplify budgeting, expense tracking, invoicing, and financial reporting.

Business Software Size: Small businesses.

Price: It offers four different pricing plans:

Simple, which starts at $30/month for one user.

Essentials, currently at $50/month for three users.

Plus, $85/month for five users.

Advanced, $200/month for more than five users.

Great for: QuickBooks Online is ideal for small businesses and self-employed individuals who require an intuitive and user-friendly budgeting solution. It caters to a wide range of industries and is suitable for businesses looking for an accounting software that is both affordable and accessible.

Advantages: It has a very user-friendly UI which makes it very easy to navigate. It integrates seamlessly with third-party applications, while also being able to carry out expense management and categorization.

Feature Highlight: One notable feature of QuickBooks Online is its budgeting tool. It allows users to set up and monitor budgets, track BvA, and gain insights into the financial performance of the business.

Lowlight: Customers comment that there is a high learning curve associated with using QuickBooks Online, particularly for small businesses with limited in-house accounting and finance experience.

8. Xero

Xero is a cloud-based accounting software known for its robust budgeting capabilities. It provides businesses with efficient tools to manage their finances and streamline their budgeting process.

Business Software Size: Small and medium sized businesses.

Price: Cost only available via custom quote.

Great for: Xero is ideal for small to medium-sized businesses looking for an intuitive and user-friendly budgeting solution. It caters to a wide range of industries and provides a comprehensive set of tools for financial management.

Advantages: Streamlined budgeting process where Xero simplifies budget creation, tracking, and monitoring, enabling businesses to stay on top of their financial goals. It provides FP&A with real-time insights into their budget performance.

Feature Highlight: One notable feature of Xero is its flexible budgeting tool. It allows businesses to create budgets based on various criteria such as timeframes, departments, or projects. Users can set budget goals, track actual expenses against the budget, and generate reports to assess budget performance.

Lowlight: Some common customer complaints regarding Xero are the limited number of dimensions, and the lack of customization in its dashboarding capabilities.

9. Workday Adaptive Planning

Workday Adaptive Planning is a versatile enterprise planning management software that enhances data analysis and decision-making across departments. It connects with ERP systems, GLs, and spreadsheets, automating forecasts and generating insightful management reports.

Business Software Size: Enterprise level businesses.

Price: Cost only available via custom quote.

Great for: Large enterprises seeking a comprehensive tool for various functions. Workday Adaptive Planning excels at handling extensive data, which sets it apart from other applications.

Advantages: Workday Adaptive Planning offers unparalleled cross-functional capabilities, empowering finance teams to become strategic business partners.

Feature Highlight: Workday recognizes the interconnectedness of workforce management, labor metrics, and FP&A. It integrates employee information with financial data, delivering valuable insights for both HR and FP&A departments.

Lowlight: While customers appreciate the versatility of Workday, some struggle with its slow calculation speed and limited customization options. The inability to accommodate irregular or manually-added data inputs poses challenges for organizations with unique requirements.

10. Excel/Google Spreadsheets

Excel and Google Sheets are often the default choice for many businesses. They're extremely powerful and flexible, but as your business grows, you might face limitations that can slow down finance teams.

Business Software Size: Small and medium sized businesses.

Price: Free for Google Sheets; Excel pricing depends on your Microsoft 365 subscription or a standalone purchase.

Great for: Organizations that want a familiar environment for financial data entry and simple collaborations.

Advantages: They offer broad flexibility and universal accessibility, making them easy to adopt.

Feature Highlight: You can automate data ingestion or integrations through third-party tools, plus create complex formulas and pivot tables as needed.

Lowlight: As businesses scale, version control and collaboration become cumbersome, and manual data entry increases error risk.

Learn more:

Excel for Finance: take your financial automation to the next level

3 top Excel automation tools to drive finance teams productivity

Rating Overview for Budgeting Software Tools

For a quick overview of how these different budgeting tools compare, our helpful table below provides an overview of the software. We’ve included our own assessment as well as a rating based on validated user reviews on the G2 platform (updated for November 2025).

Software | Our Rating | G2 Rating (November 2025) |

|---|---|---|

Abacum | 5/5 | 4.8/5 |

Prophix | 3.7/5 | 4.4/5 |

Planguru | 3.8/5 | 4.5/5 |

Budgyt | 4/5 | 4.8/5 |

Sage | 4.1/5 | 4.3/5 |

Microsoft Dynamics | 4/5 | 4/5 |

Quickbooks Online | 4.2/5 | 4/5 |

Xero | 4.1/5 | 4.3/5 |

Workday Adaptive Planning | 4.4/5 | 4.3/5 |

Excel (GSheets) | 4.5/5 (4.5/5) | 4.7/5 (4.6(5) |

Ultimate Budgeting Software: Abacum

Designed for mid-sized businesses, Abacum provides companies with a complete budgeting solution that can be fully integrated into company processes.

If you are still not sure which budgeting software is right for your business, Abacum is the perfect solution. It is the leading mid-market budgeting software for companies across several industries.

Key reasons Abacum's budgeting software stands out:

Abacum's in-house implementation team provides support and training so you can complete your budgeting process on time.

Abacum is user-friendly and intuitive. Unlike other tools requiring heavy technical expertise from budget owners, Abacum offers smooth workflows.

Its excellent UX and UI drive stakeholder adoption across the business.

Features like automated data handling, integrations with multiple data sources, and robust reconciliation let FP&A teams focus on bigger-picture analysis, whether they're using top-down or bottom-up budgeting.

Overall, Abacum's budgeting software is a flexible solution that drives efficient revenue forecasts, budgeting flows, and real-time KPI analysis. It's our top recommendation for fast-growing companies seeking advanced financial capabilities.

How to Choose a Business Budgeting Software

When you're ready to select a budgeting platform, it's wise to consider your company's size, growth plans, and tech stack. Identify the features that matter most, like automated reporting, integrations, or collaborative planning, to ensure you choose a solution that works for your business.

Future trends in business budgeting software

The world of financial planning is constantly evolving. As technology advances, budgeting software is becoming more intelligent, integrated, and indispensable for strategic decision-making.

Increased focus on predictive analytics and AI

The future of budgeting lies in predictive capabilities. AI will move beyond simple automation, introducing AI for successful budgeting to help teams forecast financial outcomes with greater accuracy. This allows for more proactive and data-driven strategic planning.

Deeper integration with operational data

Budgeting tools will increasingly connect with non-financial data sources. Integrating data from sales, marketing, and operations provides a holistic view of the business. This enables finance teams to link financial performance directly to operational drivers.

Enhanced collaborative and remote-friendly features

As remote and hybrid work models become standard, software must adapt. Expect to see more sophisticated features designed for real-time collaboration across different locations. This ensures the budgeting process remains seamless, no matter where your team is.

Conclusion and Next Steps

Evaluate Your Business Needs: Consider your specific requirements and goals for budgeting software. Think about scalability, integrations, ease of use, and pricing, aligning each factor with your company's size and industry.

Explore Further Resources: Learn more about financial management and budgeting solutions by exploring additional guides from Abacum. Check out best practices, emerging trends, and innovative technology in this field.

Alternatively, you can read more about financial planning softwares for SMBs.