TL;DR |

|---|

|

What is Financial Planning and Analysis (FP&A)?

Financial Planning and Analysis (FP&A) is the process of creating, managing, and analyzing a company's long-term financial plans. FP&A teams combine financial expertise with strategic planning to help organizations make informed decisions, improve efficiency, and achieve their objectives.

FP&A is more than just number-crunching. It involves collaborating with different departments to understand their needs and aligning financial planning with broader company goals. This partnership provides valuable insights that guide better business decisions and drive sustainable growth.

What is a FP&A Software? Understanding the Best FP&A Tools…

FP&A software is a specialized platform designed to support comprehensive financial analysis and operational planning. These tools provide data-driven insights for budgeting, forecasting, cost management, and performance optimization.

According to DataHorizzon Research, the global FP&A software market is valued at USD 4.38 billion in 2024 and is projected to reach USD 11.67 billion by 2033, reflecting a 10.3% CAGR.

FP&A software enables organizations to gain real-time insights into their financial health. The software can be tailored to meet unique business requirements, offering detailed reports on revenue, expenses, and cash flow. It also generates rolling forecasts and models different business scenarios. For example, FP&A technologies have reduced budget finalization from 45 days to just three days in documented cases (Oliver Wyman).

What are the Benefits of implementing a FP&A Software into your Business?

FP&A teams are central to a business’s financial health, providing a comprehensive understanding of all organizational aspects. Their responsibilities range from management reporting and sales quota attainment to headcount planning and budget ownership.

Modern CFOs empower FP&A teams to move beyond enforcing budgets and become facilitators of revenue generation. This transformation delivers several key benefits:

Complete understanding of business performance: FP&A teams gather data across departments, enabling granular performance measurement and improved accountability.

Balancing short-term and long-term strategic planning: FP&A helps stakeholders quickly respond to market changes while staying aligned with long-term goals.

Translating data and insights into clear actions: FP&A converts insights into actionable plans, collaborating with teams to drive measurable change.

Improved collaboration and control: FP&A unifies cross-departmental data, ensuring decision-makers have the right information and maintaining data security through selective permissions.

Advanced analysis at any scale: FP&A leverages scenario analysis and AI-powered tools to identify trends and deliver insights for organizations of any size.

Key Features to Look for in Modern FP&A Software

Choosing the right FP&A tool means focusing on features that empower your finance team and move beyond basic spreadsheets. The following features are essential for dynamic, collaborative, and insightful financial management:

Seamless data integration

Modern FP&A software should connect with all your data sources. Look for pre-built connectors for ERP, CRM, and HRIS systems. This integration creates a single source of truth, eliminates manual data entry, and ensures your analysis is based on accurate, real-time information.

Advanced scenario planning and forecasting

Effective FP&A tools enable forward-looking analysis. Capabilities like what-if analysis, driver-based planning, and rolling forecasts help you model different business scenarios, prepare for uncertainty, and make proactive decisions.

Intuitive data visualization and reporting

Financial data must be accessible to all stakeholders. Top FP&A tools offer customizable dashboards and data visualization features, allowing you to create clear, compelling reports for department heads and executives.

Collaborative workflows and version control

Collaboration is key in financial planning. Look for software with shared workspaces, commenting, approval workflows, and robust version control to ensure everyone works from the most current data and assumptions.

Robust security and access control

Financial data is sensitive. Ensure your FP&A tool has strong security measures, such as data encryption and regular backups. Role-based access controls are essential for managing who can view, edit, and approve financial information, maintaining data integrity and compliance.

Key Considerations for Choosing FP&A Software

Selecting the best FP&A software is a critical decision that can transform your financial planning, analysis, and reporting. To ensure the right fit, evaluate these key points:

Fit for purpose and customization

Assess how well the software meets your specific objectives and operational needs. The platform should support your financial planning, analysis, and reporting processes and offer flexibility in dashboard configuration, reporting, and modeling capabilities.

Implementation and user adoption

Ease of implementation and integration is vital. Evaluate compatibility with your existing systems and the availability of training resources. Integration with ERP, CRM, and BI systems ensures a smooth rollout and faster user adoption.

Data integrations and accuracy

Data accuracy and reliability are foundational for effective FP&A. Look for strong data management practices, including data consolidation, validation, and governance, to support accurate decision-making.

Competitor analysis shows that robust data integrations, user-friendly interfaces, and detailed ROI comparisons are top priorities for finance teams.

Pricing and vendor support

Ongoing vendor support and continuous improvement are crucial. A responsive support team, frequent software updates, and a clear development roadmap help ensure long-term success.

By focusing on these considerations, fit for purpose, customization, implementation, data accuracy, and vendor support, you can unlock the full potential of your FP&A solution and drive business growth.

Evaluating the global scalability of an FP&A software

A tool may work well for a single business unit, but true global scalability requires a broader set of capabilities. Here’s what to look for:

Multi-entity and multi-currency support: The platform should consolidate data across subsidiaries and automatically handle currency conversions, exchange rates, and local reporting standards.

Regulatory compliance: Global operations mean dealing with diverse accounting frameworks (e.g., IFRS vs. GAAP) and tax regulations. Scalable platforms are designed to adapt to these regional requirements.

Performance at scale: The software must process large volumes of financial and operational data quickly, even as the business grows or acquires new entities. Look for features like data warehousing, high-volume ETL pipelines, and optimized calculation engines.

Role-based access and governance: With teams spread across geographies, you need fine-grained permissions and audit trails to keep sensitive data secure while enabling collaboration.

Localization and collaboration tools: Global teams benefit from multi-language interfaces, time zone awareness, and shared workflows that connect finance with local business units.

When evaluating FP&A solutions, it’s critical to test not just core planning functionality, but also how well the platform adapts as your organization expands internationally. A truly global-ready solution grows with you, supporting new entities, regions, and data sources without disrupting workflows.

Abacum was designed to scale with mid-market companies:

Unlimited dimensions and custom metrics → plan by product, market, channel, or any driver without hitting caps.

Best-in-class integrations → NetSuite, Sage, HRIS, billing systems, with self-serve ETL to handle high-volume data.

Snapshot datasets → critical for headcount and historical tracking as organizations grow.

Scenario & versioning engine → spin up what-if cases instantly without breaking the core model.

Collaborative workflows → scale planning beyond Finance by engaging dozens of budget owners securely

How to Choose the Right FP&A tool for your Company Size and Industry

The best FP&A software for your business depends on your company's size, complexity, and industry. A tailored approach is essential for finding a solution that will scale with your needs.

For startups and small businesses

Startups often prioritize ease of use, affordability, and core functionality. Initially, tools like Excel or Google Sheets may suffice for basic budgeting and forecasting. As the business grows, dedicated platforms with simple interfaces and quick implementation become more attractive.

For mid-market and scale-up companies

Mid-market companies require a balance of power and flexibility. Finance teams need tools that support scalability, advanced scenario planning, and complex headcount planning. Platforms like Abacum offer robust integrations and collaborative workflows without the rigidity of enterprise-level systems.

For large enterprises

Large enterprises face complex requirements, including multi-entity structures and vast datasets. They need comprehensive solutions for corporate performance management, financial consolidation, and stringent security protocols. Tools like Anaplan or Workday are built to handle these needs.

Considerations for specific industries

Industry-specific metrics are important. For example, a SaaS company must track metrics like MRR, churn, and LTV, while a manufacturing company may focus on inventory costs and supply chain logistics. Choose a tool that can model the metrics most relevant to your industry.

What are the Best FP&A Software Tools for 2026?

With the FP&A software market rapidly evolving, it’s important to identify platforms that meet the needs of businesses at every stage. Our curated selection of the 11 best FP&A software platforms in 2026 is based on features, scalability, pricing, and user feedback. This approach ensures transparency and builds trust in our recommendations.

Our evaluation goes beyond feature comparison, focusing on real-world applicability and the evolving needs of modern businesses. By prioritizing transparency and practical insights, we help organizations navigate the complex landscape of FP&A software selection with confidence.

1. Abacum

Abacum enables businesses to accelerate scenario analyses, automate budgeting workflows, streamline leadership approvals, and consolidate bottom-up and top-down forecasts. With faster access to insights and enhanced analytics, Abacum serves as a single source of truth for automating critical budgeting processes and consistently delivers tangible value to users.

Key features: Headcount planning, what-if analyses, vendor-level budgeting, reporting templates, budget approvals, and core workflow functionalities.

What to look out for: Abacum is best suited for FP&A leaders at mid-market startups and scaleups who need a robust yet flexible planning solution.

Customer support: Abacum provides a dedicated support team, an academy, and in-depth updates on new features.

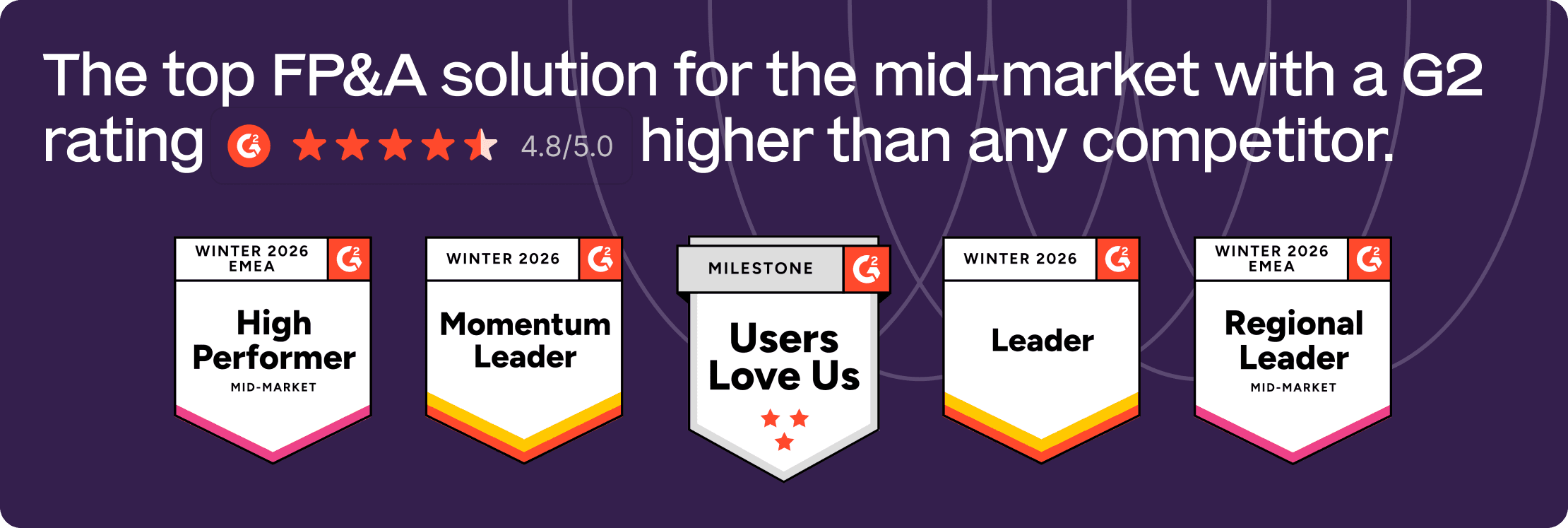

G2 Rating: 4.8/5

Website: Abacum

Is Abacum SOC compliant?

Yes, Abacum takes security and compliance seriously. While specific SOC 2 Type II certification details aren't publicly available, Abacum implements enterprise-grade security measures to protect your financial data. The platform follows industry best practices for data encryption, access controls, and secure infrastructure.

For detailed information about Abacum's current SOC compliance status and security certifications, we recommend contacting our team directly. They can provide comprehensive documentation about our security framework and compliance roadmap that meets your organization's requirements.

2. Anaplan

Anaplan is a dynamic planning platform that empowers data-driven decision-making and adaptability to market changes. Its flexible architecture optimizes planning processes and fosters agile operations, making it a leader in enterprise planning.

Key features: Robust calculation engine, planning at any level of granularity, entity consolidation, real-time collaboration, modeling, and simulations.

What to look out for: Anaplan is ideal for large enterprises with over 1,000 employees, especially when processes have grown too complex for smaller solutions. It has a steep learning curve and requires dedicated implementation resources, often through third-party providers.

Customer support: Anaplan offers a highly regarded support page, community, and dedicated support team.

G2 Rating: 4.6/5

Website: Anaplan

3. Microsoft Excel

Microsoft Excel remains the most widely used software for financial planning and analysis. Its versatility and accessibility make it suitable for everyone from small businesses to finance professionals at large corporations.

Key features: Extensive formulas and customizability.

What to look out for: Excel has limitations in automating data ingestion, collaboration, and multi-dimensional modeling. You must acquire the Microsoft Suite to use Excel.

Customer support: There is extensive documentation and community support for Excel users.

G2 Rating: 4.7/5

Website: Microsoft Excel

4. Google Sheets

Google Sheets is a cloud-based alternative to Excel, known for its collaborative features and accessibility. Its cloud-based nature allows for real-time collaboration and easy sharing.

Key features: Integration with CRMs and ERPs, automated data export, and collaborative commenting.

What to look out for: Google Sheets shares some limitations with Excel. You need a Google account to use it.

Customer support: Extensive documentation and community resources are available.

G2 Rating: 4.6/5

Website: Google Sheets

5. Vena Solutions

Vena Solutions is a comprehensive financial management platform, ideal for centralized budgeting and workflow. Its similarity to Excel provides flexibility for finance professionals.

Key features: Centralized budgeting and forecasting, data integration, scenario modeling, reporting and analytics, workflow automation, collaboration, audit trail, regulatory compliance, and adaptability.

What to look out for: Vena is best for organizations that rely heavily on Excel but need to overcome its limitations.

Customer support: Vena offers resource pages, a community, Excel templates, forums, and an academy.

G2 Rating: 4.5/5

Website: Vena

6. NetSuite Planning and Budgeting

NetSuite Planning and Budgeting streamlines finance operations by automating planning, budgeting, and forecasting. It enables efficient plan creation, scenario modeling, and report generation, reducing manual tasks for finance teams.

Key features: Seamless integration with business bank accounts and customizable reports.

What to look out for: Best for businesses already using NetSuite as an ERP. Requires the budgeting and forecasting pack, which increases costs, and implementation can take 6–12 months.

Customer support: NetSuite offers a comprehensive resource center and highly rated customer service.

G2 Rating: 4.0/5

Website: NetSuite

Learn more: Best NetSuite integrations for Finance Teams: Picking from 12 tools

7. Cube Software

Cube Software is a centralized FP&A solution that helps companies manage their entire financial planning process efficiently.

Key features: Secure data management, seamless integration with various tools, scenario planning, and customizable dashboards with data visualization.

What to look out for: Cube is tailored for scaling startups that want an FP&A platform that can grow with them but is more Excel-based. Some flexibility limitations exist, as companies must adapt their financials to Cube’s platform.

Customer support: Cube’s implementation and customer success teams are highly regarded for their speed and involvement.

G2 Rating: 4.5/5

Website: Cube Software

8. Prophix

Prophix is a Corporate Performance Management (CPM) software designed to enhance profitability and reduce risks associated with errors.

Key features: Data visualization, variance analysis, and multiple scenario planning.

What to look out for: Prophix is best for organizations needing a robust financial performance management platform for budgeting, planning, and forecasting. It serves a wide range of industries and finance teams.

Customer support: Prophix provides a dedicated customer service team, an academy, and in-person or online courses.

G2 Rating: 4.4/5

Website: Prophix

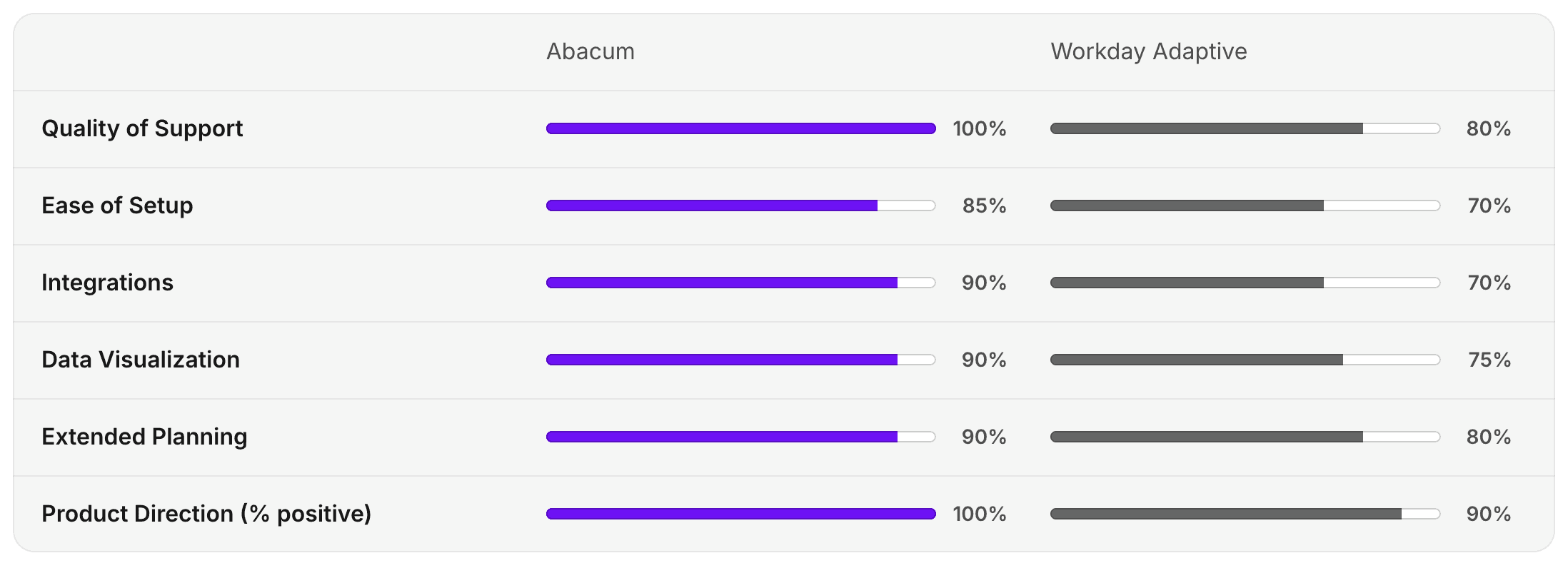

9. Workday Adaptive Planning

Workday Adaptive Planning empowers agile decision-making with robust modeling and analytics. This cloud-based application helps enterprises adapt to changing business conditions with ease.

Key features: Multi-dimensional modeling, OfficeConnect for seamless report creation in Microsoft Office, Excel report connectivity, and version control.

What to look out for: Workday Adaptive Planning is ideal for large enterprises managing extensive data. Its ability to handle large datasets sets it apart.

Customer support: Some users have noted that learning resources could be improved.

G2 Rating: 4.3/5

Website: Workday Adaptive Planning

Source: G2

10. Jedox

Jedox offers a dynamic planning and performance management platform, enabling organizations to exceed expectations with their plans.

Key features: Customizable permissions, robust ETL process, task automation through code execution, and an Excel add-in.

What to look out for: Jedox is designed for finance departments and planning teams that need a flexible and comprehensive planning solution.

Customer support: Jedox provides an academy, training videos, calendars, and support centers.

G2 Rating: 4.3/5

Website: Jedox

11. Planful

Planful is a financial performance management platform that helps organizations make impactful business decisions and acts as a single source of truth for financial and operational data.

Key features: Interactive dashboards, Microsoft Office integration, and direct reporting to stakeholders.

What to look out for: Planful is best for finance departments and planning teams that require a flexible and comprehensive planning solution.

Customer support: Customers praise Planful’s support and resources.

G2 Rating: 4.3/5

Website: Planful

Source: G2

How do Pricing Tiers Affect Functionality in FP&A Solutions?

Many FP&A vendors lock critical functionality behind pricing tiers, forcing CFOs to pay more just to unlock features they assumed were standard:

Mosaic: splits pricing between reporting and planning. Companies often start small but quickly face upsells when they need full planning capabilities.

Pigment & Anaplan: enterprise-style pricing. Multi-tiered plans that require six-figure ACVs to access advanced modeling, workflows, or integrations. Mid-market CFOs often overpay for features they’ll never use.

Vena, Cube, Datarails: appear cheaper but charge add-ons for integrations, headcount planning, or advanced reporting — and since they’re Excel-wrapped, much of the “functionality” still depends on manual work.

Where Abacum fits: Abacum takes a different approach:

Transparent mid-market pricing — no hidden upsells to access core FP&A features.

All-in-one functionality included: advanced modeling, workflows, approvals, integrations, and reporting are standard.

Scale without surprise costs — as your team grows, Abacum scales with you, without forcing you into an “enterprise tier” to unlock what you actually need.

Conclusion and Next Steps

After comparing FP&A software solutions, several key insights emerge for businesses of all sizes. Abacum stands out for scenario analysis and streamlined workflows, making it ideal for mid-market startups and scaleups. Anaplan suits large enterprises, while Microsoft Excel and Google Sheets remain versatile for simpler needs.

Vena Solutions bridges advanced financial management with an Excel-like interface for established organizations. NetSuite Planning and Budgeting streamlines finance operations for NetSuite users. Cube Software supports scaling startups, Prophix delivers broad corporate performance management, Workday Adaptive Planning excels with large datasets, Jedox offers dynamic planning, and Planful is a comprehensive solution for finance teams.

To make the right choice:

Assess individual needs: Evaluate requirements for budget, scalability, and features that align with your growth stage.

Explore additional resources: Consult FP&A automation tools guides from trusted sources like Abacum for deeper insights and industry expertise.

Seek personalized assistance: Contact Abacum for expert help in selecting the right FP&A solution with confidence and clarity.

By following these steps, you’ll simplify the selection process and align software capabilities with your objectives.

FP&A is a critical process that combines financial principles with strategic planning to help businesses make smarter decisions and achieve lasting success. Scenario planning, identifying success factors, measuring progress, and analyzing budget variances are key principles in effective financial management.

Abacum as the next step for success

Top FP&A software tools like Abacum support financial analysis and planning at various scales. Choose the platform that fits your needs by balancing features, cost, and ease of use.

Abacum is designed for mid-sized companies that want to automate workflows, get real-time insights, and transform planning, forecasting, and strategy.

Streamlined implementation: Our dedicated team ensures a smooth onboarding, with ongoing support.

User-friendly experience: Abacum’s intuitive workflows suit any finance team, letting you focus on strategy over data entry.

Integrated financial planning: It automatically consolidates data from multiple sources, minimizing manual tasks.

Real-time forecasts: You’ll access up-to-date forecasts for quicker, informed decisions.

Customized planning templates: Adjust built-in templates to fit your unique financial strategies.

Exceptional UX and UI: Its clean interface simplifies collaboration and drives alignment.

Advanced features: Automate data wrangling, integrate budgeting methods, and focus on critical analysis instead of manual inputs.

When it comes to financial planning for mid-market companies, Abacum stands out by driving efficiency, accuracy, and strategic growth. Join us to unlock your business’s true potential.

For more insights, explore FP&A software implementation best practices here.