Okay, the raise is done. The docs are signed. The wire has hit the account. Merry Christmas, Happy New Years! Now what? Well… Here are some multiple choice options:

Trash $400-500m on marketing before establishing product-market fit (Quibi)

Spend $40-$50m on product demos and R&D without selling a product (Magic Leap)

Lure star writers by paying them $17m more than you earned (Substack)

Go from $4m ARR to $800m in four years through disciplined growth (Deel)

If you answered anything but D, you probably shouldn’t be in the CFO seat.

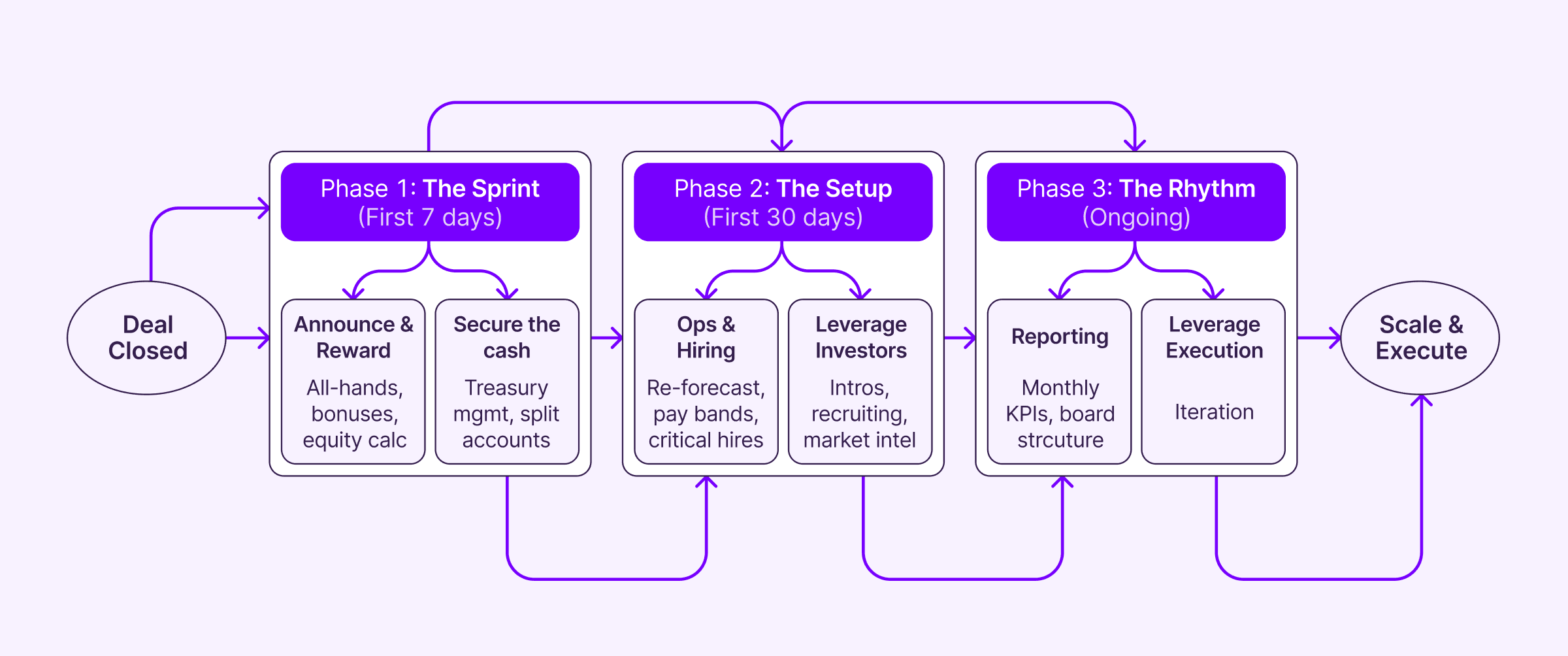

Celebrate the gift, but don’t lose the momentum. It’s a new phase, a new year. The perfect moment to lock in your wins by doubling down on the strategy that you presented and meticulously put together over the previous months (New Year Resolution?).

Practically, this means celebrating with your team, rewarding those who made this happen, stewarding the cash you just received, and moving quickly to leverage the new funding and VC relationships.

The Bullets

|

Well, not much more to say. This is the fun part, so enjoy!

Let’s get to it.

1. Announce the deal

The rumor mill has probably been running for weeks. Some team members already know. Some think they know. So get ahead of the story and own the message because it's a great morale boost. To do so:

Celebrate the win. This is a huge milestone. Acknowledge the work the entire company did to get here. A meet-up within a month of a raise can be a strong launching point into what you are actually going to do with the money.

Hold an all-hands. Give a company-wide update that walks through what happened, why it matters, and what’s next.

Reward the team. (More on this below.) People need to know what this means for them.

Explain the “why.” Why did you raise? What are you trying to accomplish with this capital?

Set next steps. What are your immediate priorities? Where is this money going, and how will success be measured?

Much of this content is already in your investor deck, just reshape it for internal use. Strangely, a lot of teams neglect to do this step and simply say “X raised at Y” which leaves a lot of the team incredibly confused.

Tip: Deliver this message within a week of closing. Delay too long, and you lose the chance to use momentum as a unifier.

2. Reward the team

Too often, fundraising feels like a win for founders and execs but leaves employees wondering what’s in it for them. There is no reason to not make this a win-win for everyone.

Option refresh/retention. Use this moment to refresh grants for key team members. Help offset dilution and re-engage mid-tenure staff.

Meaningful bonuses. A one- or two-month salary bonus across the board can go a long way. It says: you helped make this happen.

Avoid token gestures. Pizza parties are fine, but not as your only reward. Do something that’s tangible and personal.

Pay band reviews. This doesn’t need to be announced, but often new money brings in new people with more experience that demand higher pay. Make sure you go ahead and review where your current team is and make any adjustments so that people don’t feel underappreciated and you don’t create an old vs. new split.

Make people feel they’re building the company, not just working for you. And, yes this takes more than tokens.

Tip: Build a simple equity estimation calculator for employees that have options (with the massive caveats of course) as this is the first thing that everyone wonders. Make sure you factor in estimated future dilution to make it clear.

3. Invest the cash

You’re now the guardian of a big chunk of cash. So get on it immediately. Start putting the money to use immediately.

Separate operating vs. excess funds. Keep 3–6 months of operating cash in your primary account. Everything else should be set aside for longer-term plans or invested conservatively.

Invest excess capital. You can’t take major risks, but laddered bond investments or short-term treasuries can provide safe returns and stable liquidity.

24+ month cash forecast. Redo your cash model with conservative assumptions—lower revenue, higher costs. Stress test it.

No surprise spending. Stick to the plan you just sold to investors. No new offices. No bloated hiring. Execute first.

Measure your hires. Make sure that you are hiring at the same standard or higher than you have before. Nothing will slow you down or burn through more cash than a hiring spree gone wrong.

Of course you don’t want to go into anything that is risky here. But, there is no reason not to start earning basic interest in insured accounts.

Tip: Don’t leave millions in one uninsured bank account. Spread funds across insured institutions or use cash management tools. (SVB wasn’t long ago…)

4. Leverage your new investors

VCs are more than a check, so this is the best time to tap into what else they can offer. They will often be flattered by this help as well.

Warm intros. Whether to customers, partners, advisors, or press, ask for specific, actionable help to get the round publicized and introductions to new potential customers.

Hiring help. Use their recruiter networks carefully. They can be a powerful asset but set expectations clearly so that you don’t get passed around to someone who will really slow you down.

Market insight. Leverage their portfolio to understand where the market is going and how others in your space are positioning. This is usually more informal, but make sure you are asking for updates from their side each month as well.

Just like anything else, there is a lot of leverage at the beginning of the relationship, let’s call it the honeymoon phase. Use it to push things forward and have them start helping you.

Tip: Be specific. Don’t just start using a consultancy or advisors because you can. First, have a very very specific problem and then go to the VC to avoid wasting any time.

5. Nail the first month

You just spent months planning. Now act. You are going to want to re-establish what you have just committed to so you can move forward with hitting the goals you just discussed with investors.

Implement now what pays off next quarter. Infrastructure, ops upgrades, automation. You will get a little bit of time after a raise to move quickly, but it will go surprisingly quickly.

Tie team benefits to near-term performance. Use the energy from the raise to drive short-term wins that add up over time.

Roll out budgets and operational plans. This means that all teams should know what they are doing and where they are heading with the new resources.

Make your critical hires. If they were contingent on the raise, then make sure they know you are now ready for them to join the team.

Ideally, you will go through this process many times in the company's life. Oftentimes, these are periods of high energy that can move things forward quickly so you want to ride the raise.

Tip: The last thing you want is to miss the first quarter's targets by 40% because you were focused on raising money and took a backseat to operations.

6. Report your first results

You’ve closed the raise but your investor relationship is just beginning. You will be working with them for years so the last thing you want is just to go silent after taking their money.

Start reporting immediately. Send a brief note within 30 days that gives a status update and invites them to the conversation.

Use consistent, reliable metrics. Share the same KPIs every month. Build credibility fast by just doing things consistently.

Highlight early wins. Nail one or two product or growth milestones early and use them to reinforce confidence.

Upgrade board structure. Standardize meeting cadence, format, and prep materials. You want board meetings that drive value.

Get the process started. Your investors will have made other investments, so you want to start out setting up a direct line into your partners.

Tip: Commit to sending out the same set of metrics every month with a couple of bullet points and then giving the full board deck once a quarter.

7. Set up for the next raise

The next raise starts now. Take all the material you prepared and make sure it's saved. Then update the information over time by using the same processes so that you don’t have to face another rush next raise. This means:

Debrief. What was rough in this process? What dragged or created unnecessary risk? How will you fix it for the next round?

Refine. What materials, models, or messages could have been sharper? Make the changes in your current models that you use day-to-day to save a lot of time.

Track VCs who passed but were interested. Stay warm with them. They may lead your next round.

And that's it, the rest of the work should happen through the monthly management meetings and the rolling forecasts.

In conclusion

This is the fun part. Celebrate your success, the entire team earned it. Then, start the New Year with energy because the next round will be coming up faster than you think.

Happy Holidays.