The Bullets:

|

When hasn’t the world been uncertain? In the last five years, we have witnessed the 2019 beginning of the China/US trade war, the 2020–2021 global pandemic, 2022’s surge in inflation, and 2025’s tariff uncertainty. And recently, everyone from the Economist to Ray Dalio has compared the business environment to the 2000’s Dot-Com Crash. Every year seems to bring a new chorus of recession predictions.

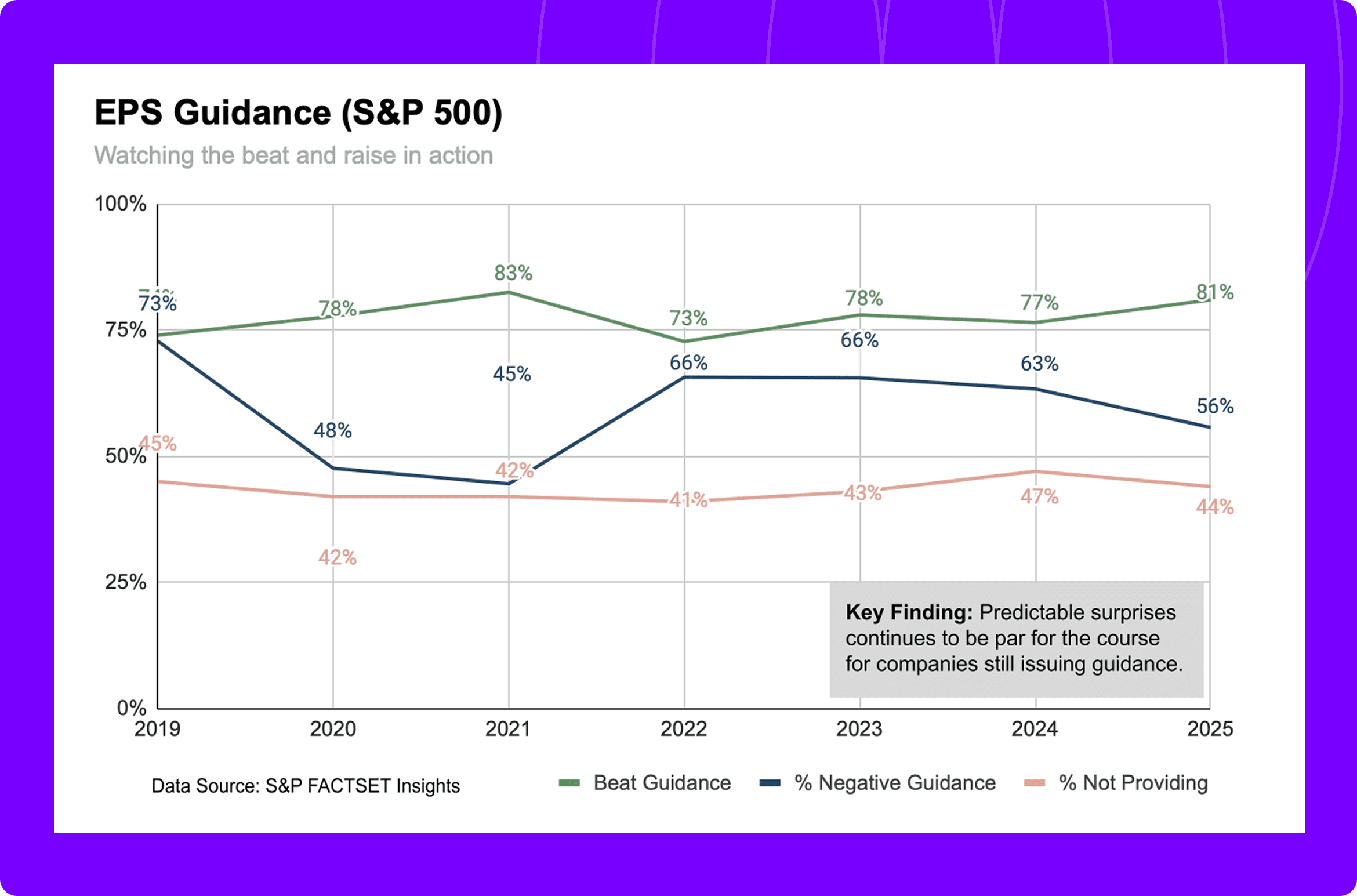

Of course, this isn't investment advice. No. We want to discuss how companies with a strong history of meeting guidance through high growth have mastered projections in order to bring you straightforward guidance on achieving the same.

Let’s start with Visa. Their CFO discusses using a range of different scenarios and drivers to model their future.

“I talked about four of these things in October... The first one being cross-border volumes... As we've all seen, post-pandemic travel spiked... we're anticipating it growing at a lower rate. It's a comparable challenge in Q1. The second one is FX volatility... The third one is non-recurring revenues... And the last one being client incentives”

Then, let’s move on to Microsoft:

“[Microsoft Modern Finance] plugs hundreds of thousands of data points into the algorithms, which learn and make predictions on future revenue, costs, headcount, even contracts at risk. The software can tell Hood what types of jobs Microsoft should hire for and how adding people in those roles correlates to sales increases, which has helped the company do a better job hiring the right kind of salespeople.”

Profile of Amy Hood, Microsoft Head of Modern Finance

What stands out here, more than the AI component, is how she implicitly notes the increased speed of financial projections that lead to actionable results.

And finally, we end with Datadog, embracing the external communication of these scenarios.

“Yeah. So as everyone knows, when we give guidance, we don’t assume these rapid growth rates. We heavily discount it. So I want to separate that out. So when we talk to you, we are discounting and risk assessing that.”

In sum, it’s about speed, predictions, and external communication. These companies operate across many business units in hundreds of countries. And still, they have been able to master their financial projections during rapid growth. These are our take-aways for scaling companies:

Make the reforecast process quick (whether AI-enabled or not)

We’ve spent a fair amount of time proclaiming the merits of rolling forecasts, management reviews, and hybrid planning models. At the heart of this advice is the need for speed. You want to be able to update your forecasts quickly to incorporate new information so you can spend more time focusing on actions. The last thing you want is to wind up reconciling data at the end of the month, having department heads trying to learn a new view or tool every six months, and then debating the quarter’s plans into the second week of the month… been there.

To emphasize quickness:

Set a daily KPI for data accuracy to guide your own team. This will naturally focus your team on fixing problems before the end of the month and ensure you are working from the right data.

Keep your views and templates consistent. Frequent changes force teams to relearn different cuts of the same numbers, a bigger time-suck than planning itself.

Time-box the process. Agree on clear limits for your next forecast window. Shrink these timeframes over time so you identify the bottlenecks and remove them.

Yes, you may find, like Microsoft has, that AI can enhance this process. But until you apply real rigor, it won’t be clear where AI should be directed to help.

Tip: You need to set tight timelines for the entire close-to-forecast process. Your updates should be completed several days before the end of the month.

Maintain ranges and scenarios for each business unit

It’s no longer enough to plug a single scenario model into a complex business model to answer, “What if we miss revenue by 10%?” In the Visa CFO’s statement alone, he identified several different drivers and businesses that would have been scenarioed out across countries. When multiple business units are involved, all of which have their own key drivers, you must:

Set standard, organization-wide assumptions. Every department should be forecasting against the same macroeconomic backdrop such as interest rates, sector growth, general demand, so that the company is basing their actions upon a shared foundation.

Build separate scenarios for each business unit. Understand, crucially, how those projections interact with each other.

Stress test the key variables of each business unit’s scenario. The CFO and FP&A team should be looking at the numbers down, up, around, and sideways because they have a bird’s-eye view of the organization. This isn’t just about agreeing on numbers; it’s about understanding what moves those numbers, illuminating actions that move the needle.

Establish the correlation of these scenarios across units. Forecasts rarely operate in isolation: some business units will move in tandem (recession), amplifying impact, while others will offset each other (shift from server purchases to cloud revenue). Mapping these relationships clearly allows you to anticipate crosscurrents rather than react to them.

When you roll up all these various scenarios to your company-wide forecasts, you will solve for the bounds of your performance and remove the fear of the unknown.

Tip: By finding correlations across scenarios, you may find some key drivers that are small in each business unit but material in aggregate.

Ensure you have clear gos and no-gos for each scenario

The first time I went through a full business unit scenario process, we were pumped. We had cross-referenced all the scenarios. We were ready. We ended the quarter at the bottom of the range. I went into the board meeting, “We were on forecast.” An ex-operator just looked confused and said, “You’re on the downside of your scenarios, why didn’t you course correct?” He made his point.

Once you start drifting towards a downside scenario, you should trigger pre-set actions to at least hit your baseline scenarios. These pre-packaged actions should be based on tangible results, whether it’s Trial Results (pharma), new product demand (Consumer Goods), high churn (Tech), interest rates (Finance). The last thing you want to do is trend towards a downside scenario and then pull your team away into ‘planning’ mode instead of acting.

It’s straightforward to do this:

Identify and track the key metrics for each scenario daily. Not just headline figures like revenue or costs, but the leading indicators that reveal trends early, such as conversion rates, order intake, or pipeline movement.

Agree on course-correction plans during scenario planning. For example, if demand softens, you might pull back on discretionary spending, defer a hiring push, or reallocate marketing dollars to higher-yield channels.

Tip: Missing doesn’t always mean cutting. It can also mean increasing capital investments in a new product, shifting around marketing budgets, doubling down on what is working.

Be honest in your communications

It’s natural for a boardroom to want certainty. I was sitting in another boardroom, when a VC investor slammed my estimated revenue range because they believed it signaled uncertainty. However, as the quarter progressed we sent updates to where we fell within our presented ranges. This tweak grounded further exchanges into discussions rather than the blame of a ‘miss.’ The next time I presented, they asked for the range.

The smartest thing a CFO can do is be honest about uncertainty and project conservatively. As we noted earlier, public companies have this down (beating and raising). Datadog nailed this combination by refusing to assume top-end growth rates in order to leave themselves a healthy buffer to meet targets and avoid overpromising.

Many scaling companies struggle with this. Under pressure to present a clean narrative, they back-solve projections to hit targets and then negotiate with business leaders to “agree on the number.” Or, even worse, they loosen the definition of their metrics. They then present the final rammed-through numbers as Gospel. Good finance leaders do the opposite. They openly highlight the uncertainty to the board in clear ranges, allowing teams to center discussion around being on the ‘downside range’ of performance rather than just ‘missing targets.’

Tip: If you set a range, make sure you at least beat the downward side of the range. The last thing you want to do is come back to the board and say, “I couldn’t even project how bad it would be”.

In conclusion

We showed that companies continue to set lower ranges for forecasts and then beat them. We highlighted statements from several of the companies that have mastered the process.

Finally, we dove into the specifics of how scaling companies can achieve similar success by holding a quick projection process, maintaining scenarios by business unit, ensuring clear actions for each scenario, and being honest in their external communication.