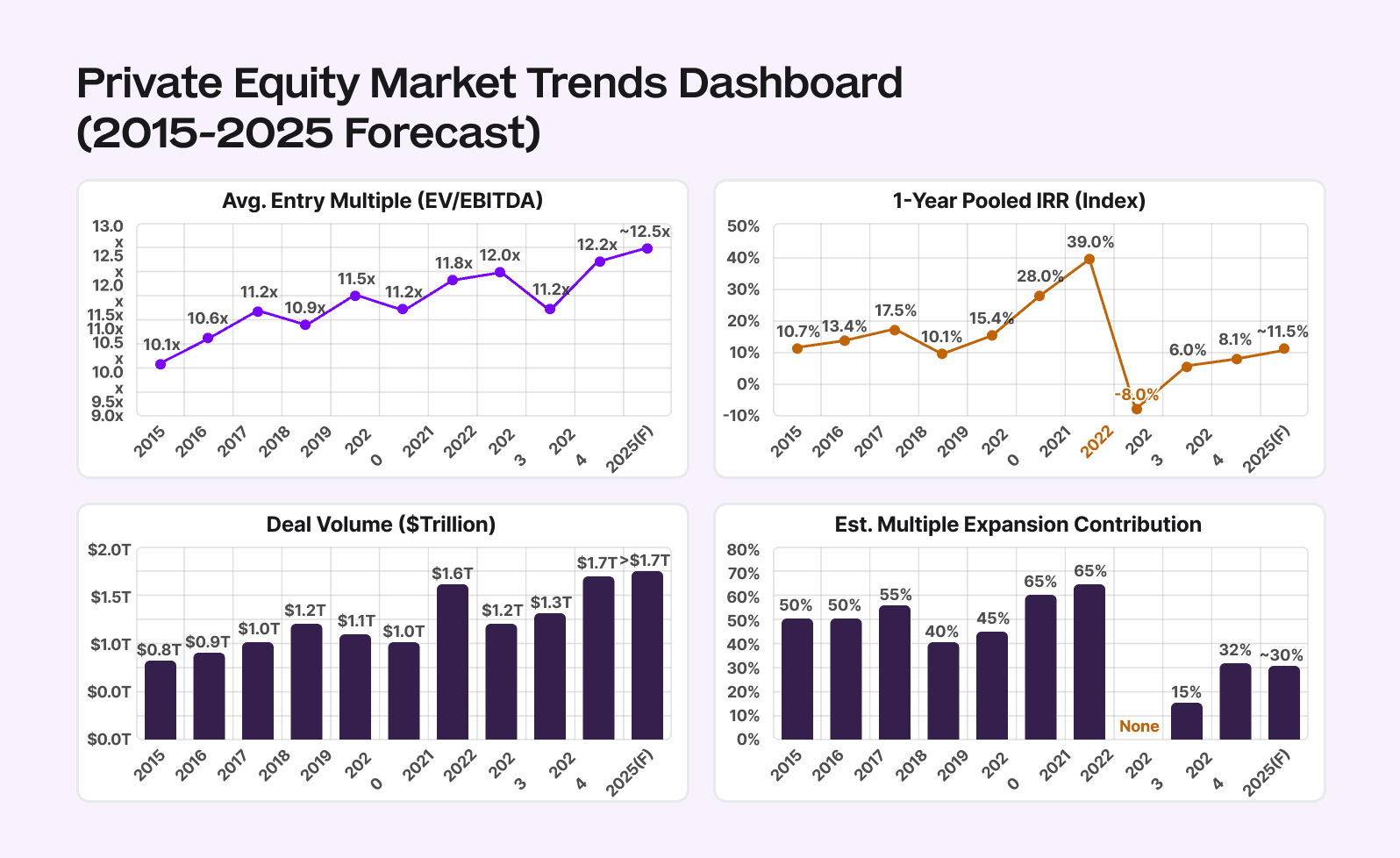

Since 2022, we’ve entered the age of the operator. Multiple expansion has compressed, deal volume remains strong, but IRRs haven’t budged. The math only works with real value creation.

There are multiple ways to do this, from cost reductions to acquisitions to new product expansion. Here are some examples:

Ellie Mae. Thoma Bravo acquired the mortgage software giant for $3.7B with ~$480M in revenue, immediately overhauling the pricing model and acquiring Capsilon to expand the TAM. Within 18 months, revenue surged to $900M, leading to an $11B sale to ICE for a 3x return on enterprise value.

Marketo. Vista bought the unprofitable marketing firm for $1.79B with ~$210M in revenue, executing their "VSOP" playbook in the first 100 days by moving HQ to Denver and replacing the C-suite to slash costs. This funded an aggressive sales expansion that doubled ARR to ~$400M, securing a $4.75B exit to Adobe just two years later.

Dynatrace. Thoma Bravo carved out from Compuware with zero cloud revenue, Thoma Bravo immediately cut $200M in shared corporate costs and eliminated legacy license sales to force a "cloud-only" pivot. This ruthless transition created a recurring revenue machine, leading to an IPO at a $4.5B valuation with $403M in ARR.

Tessara. Alterra entered with a precise plan, replacing the CEO/CFO and approving capex to double manufacturing capacity within the first 100 days to meet latent demand. These immediate moves drove 2.1x revenue and 2.2x EBITDA growth, resulting in a successful sale to strategic buyer AgroFresh.

And of course, there is the AI play. You can see that most of the work focused on transitioning products, changing pricing strategy, and major investments. So, in the first hundred days, these are the key parts of the hundred-day plan:

*Note: Acquisitions will be covered in our next article.

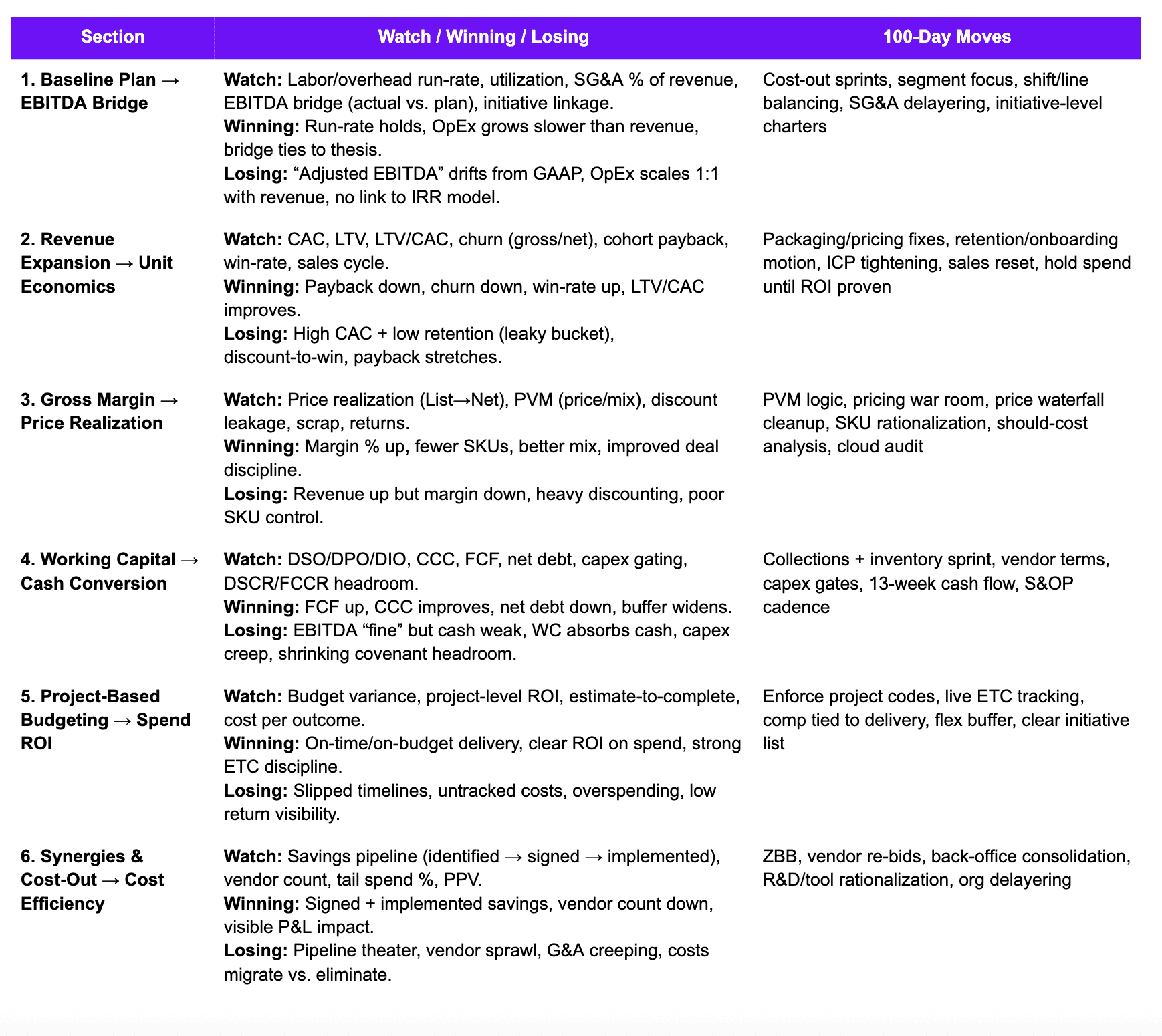

100 days goes quickly. As a finance executive, you need to prioritize ruthlessly. At the end of the article, we have a full scorecard recommendation for you.

Let’s get to work.

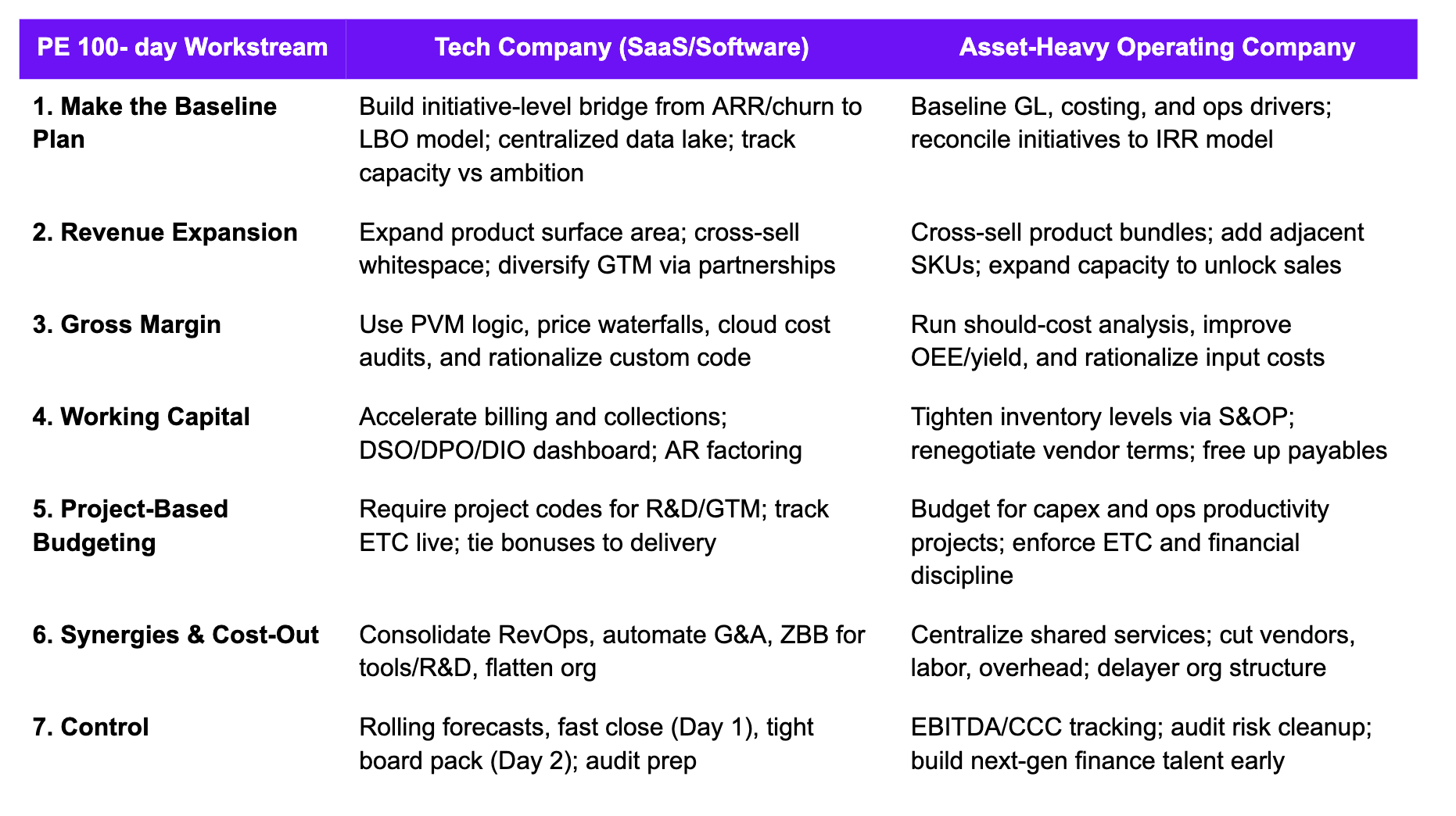

1. Make the Baseline Plan

You can’t improve what you can’t measure and you definitely can’t bank “savings” that auditors won’t sign off on later. Make a plan to bridge the gap between the investment thesis and the General Ledger.

Establish a single source of truth. Pipe data from ERP, CRM, and HRIS systems into a centralized data lake that refreshes nightly, so your burn rate and variance analysis reflect reality.

Define the benefits realization policy. Codify how each benefit to the business is calculated (PVM logic, FX normalization, counterfactuals) and validate each assumption.

Build quantified initiative charters. Move beyond a wish list to specific charters for every initiative that detail the problem, levers, costs (opex/capex), and time-phased EBITDA/cash impact.

Link the plan to the capital structure. Ensure initiative-level EBITDA/FCF reconciles directly to LBO model drivers to protect covenant headroom and validate the IRR underwrite.

Sequence based on capacity, not just ambition. Don’t jam everything into Q1. Map initiatives against resource capacity and system dependencies.

You must start with a solid foundation. It will take on various forms over the years, but this is your origin.

Tip: Your 13 week cash flow will be your constant companion to ensure you have control of the business.

2. Revenue Expansion

Expanding revenue lifts your valuation more than cutting costs. Of course, you will be expected to do both. But to start:

Expand the product surface area. Sell more to existing customers by adding on additional products or tacking on features that scale with usage.

Operationalize the cross-sell motion. Map every account against every product to reveal the whitespace. Then build dedicated expansion motions with tailored sales plays.

Customer loyalty. If repeat customers (or upsells) are failing, you’re sprinting on a treadmill. Analyze non-repeat customers by segment and solve upstream issues in onboarding and support.

Diversify the go-to-market engine. Leverage the PE ecosystem to fully pursue: partner ecosystems, integrations, marketplaces, and channel sales. These add reach without adding fixed cost

Scaling your business with products customers love is the fun part.

Tip: If your CAC payback period exceeds 18 months, you’re likely burning cash for revenue that won’t move your multiple at exit.

3. Gross Margin

As several of our examples showed, pricing matters. The first thing a finance team should prioritize is the unit economics to maximize the profit of existing products:

Implement price-volume-mix (PVM) logic. Standardize PVM sequencing for revenue and bill of materials variance for COGS to isolate exactly where margin is won or lost. Consider recurring vs. one-off pricing.

Run a should-cost procurement analysis. Don’t accept supplier pricing at face value. Be ready to rebuild with new connections. This means auditing your cloud spend.

Plug the discount leakage. Use a price waterfall (list-to-net) to find where reps are giving away margin, then enforce floor pricing and approval workflows.

Optimize manufacturing throughput. Map bottlenecks and Overall Equipment Effectiveness (OEE) to design lean wave plans that increase yield without massive capex.

Rationalize legacy customers with high amounts of custom code. Analyze contribution margins on legacy contracts. Aggressively migrate or churn customers requiring bespoke engineering support that distracts R&D from the core roadmap.

Gross margin tweaks have the added benefit of improving your unit economics and bringing in increased cash flow.

Tip: Tie GTM spend gates to LTV/CAC and payback period thresholds. Any % improvements will help across all multiples at exit.

4. Working Capital

The cheapest capital is the cash trapped on your balance sheet. We discussed capital structures early, but now will focus on the cash trapped in it rather than lender ratios.

Build a cash conversion cycle (CCC) dashboard. Track DSO, DPO, and DIO weekly, with named owners for each. Monitor liquidity headroom against covenants with a dedicated dashboard.

Make suppliers your financiers. Negotiate vendor-managed inventory or consignment stock for high-value inputs and pay only when materials arrive.

Tighten the order-to-cash cycle. Invoice milestones within 24 hours and use dynamic discounting or AR factoring to accelerate cash collection.

Establish inventory guardrails. Cap inventory (<90 days) based on demand forecasts, and run a monthly S&OP cycle to prevent overproduction.

Align incentives to cash. Don’t just bonus on EBITDA. Tie exec comp to Operating Cash Flow or working capital targets so the team feels the pain of trapped cash.

As we discussed in our article in capital stacks, you need money to pay off debt. Running leanly while scaling helps you accomplish this goal.

Tip: Fix packaging and pricing to loosen up inventory and speed up shipping times where applicable.

5. Project-Based Budgeting

We’re moving from department budgets to investment allocations. Every dollar should tie to an outcome. If a cost isn’t tied to an outcome, it should go. To do so:

Budgeting. We have written a lot about it. The key part here is to get into the details and list out all of the key projects that add value and tie back to the purchase thesis.

Require project codes for direct expenses. If there’s no project code, there’s no PO. Tag R&D and direct spend at the requisition stage.

Track estimate-to-completion (ETC) live. Don’t just monitor what’s spent. Track remaining cost weekly to catch overruns early.

Tie variable comp to project delivery. Bonus project leads for hitting targets, on time and on budget. Operational success = financial discipline.

Yes, this is slightly more overhead. But with a good system, it gives you unrivaled visibility into what is actually happening.

Tip: Consider including a flex fund buffer to the budget to keep up with the quick pace.

6. Synergies & Cost-Out: Less Headcount, More Output

Synergy is a dirty word. But it gets across the idea, be more efficient. Let’s discuss the common cost-savings that should be in the budget above:

Centralize and standardize the back office Move fast to consolidate HR, Finance, IT, and Legal into shared services. Kill redundant vendor contracts, standardize policies, and migrate everyone to best-of-breed systems (ERP, CRM, Payroll, etc.).

Rationalize talent and flatten the org. Start with a finance talent review with the question, “Can they scale at deal speed?” Then move across functions. Benchmark spans and layers to cut middle-management bloat.

Zero-based budget and automation. Legacy budgets carry legacy waste. Use ZBB to rebuild G&A from the ground up. Identify manual tasks in AP/AR/reporting, then deploy automation or RPA to lower your cost-to-serve.

Add in kill vs. accelerate reviews. Quarterly, force hard calls. Kill low-NPV R&D or slow-burn initiatives, and redeploy capital to what’s working.

You will want to do this one time quickly and hard at the beginning to clear out the fear of being fired, and get all the remaining team on the same page.

Tip: With AI ramping fast, expect back-office efficiency benchmarks to get even tighter. You’ll need systems that do more with less.

7. Control

Speed is good but not if it blindsides the board or tanks your QoE. You need operational control and reporting discipline to preserve valuation.

Tighten the forecast accuracy loop. Don’t wait for month-end surprises. Implement rolling forecasts with error tracking at the department level.

Upgrade your control environment. Simplify policy frameworks and close known audit gaps early to avoid delays in exit or refinancing.

Improve close speed and board pack quality. Target a 1-day close with board materials finalized by Day 2 with no more last-minute scramble.

Build the next-gen leadership bench. Assess key roles early to upskill or replace to avoid downstream execution risk or succession gaps.

The last thing you want is to create more confusion by losing key team members or inciting regulatory action.

In conclusion:

This is a lot to do in 100 days. But, these are the bones to put in place to ensure you can move quickly and will be able to continue with these changes.