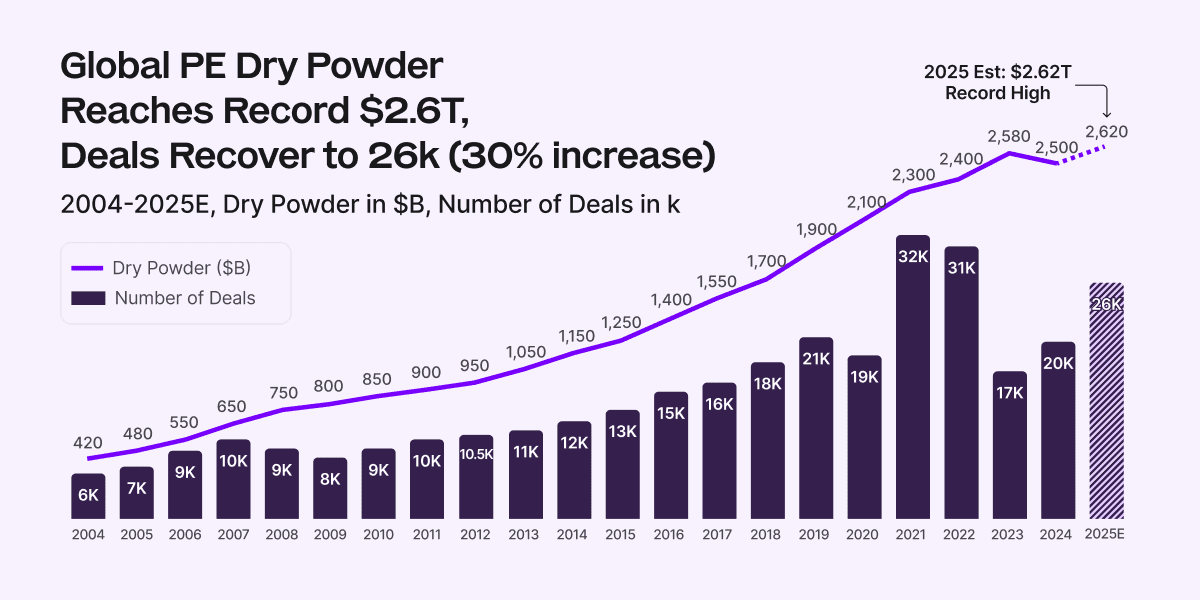

Capital continues to slosh around the world in search of returns. Private equity is sitting on record levels of undeployed capital (dry powder) which needs to be deployed or returned over the next couple of years. AI promises to save costs and generate revenue, but the cost of doing so, well, at small companies can be daunting. It also promises to supercharge deal speed. Cue the year of the AI roll-up.

We start our new guide on Private Equity in the AI age with the following thesis:

PE is under pressure to make deals and return cash to LPs.

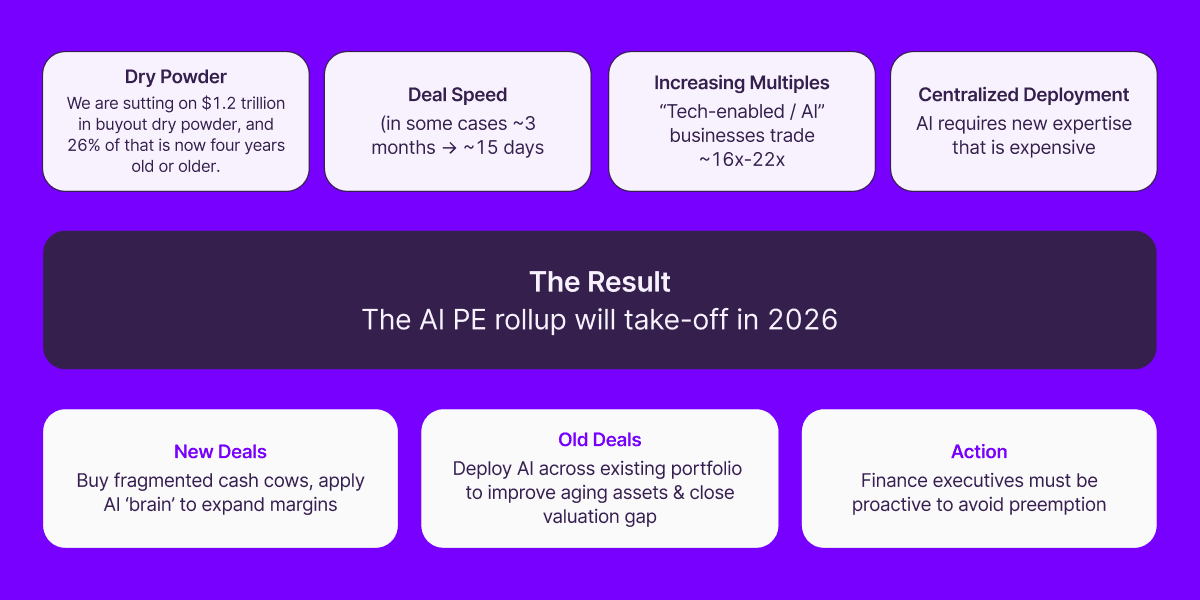

Dry Powder. They are sitting on $1.2 trillion in buyout dry powder, and 26% of that is now four years old or older.

Duration Risk. The average buyout holding period hit 6.7 years in 2024, a full year longer than the 20-year average. This has created a massive backlog of 29,000 unsold companies representing $3.6 trillion in unrealized value.

AI increases deal speed.

Sourcing → diligence → onboarding cycles compress (in some cases ~3 months → ~15 days) → more deals executed + faster integration.

AI increases multiples.

“Tech-enabled / AI” businesses trade ~16x–22x vs many traditional businesses around ~8x → opportunity to buy lower, “AI-enable,” and sell higher.

AI starting to prove upwards of 20% increase in revenue and significant decreases in cost

Centralized deployment of AI works

Many firms don’t have the expertise to automate quickly. PE firms have built their own centers of excellence. This gives them the competitive advantage in deploying AI vs. homegrown tools.

The Result:

The AI PE rollup will take-off in 2026

New deals. Buy fragmented, “low-tech” cash cows and apply a centralized AI “brain” to expand margins and increase exit multiples.

Old deals. Deploy AI across the existing portfolio to improve performance of aging assets and close the valuation gap between original expectations and actual deal outcomes.

Finance executives must be proactive or else risk being preempted

Several global PE firms have already raised multi-billion-dollar funds aimed at the mid-market, built on the thesis that AI makes operational improvement faster and more repeatable. But 2026 will be the year that AI turns value creation into a repeatable operating system, making mid-market roll-ups faster to integrate and easier to scale.

For finance executives, this means PE will become a bigger part of your deal landscape, whether you already work in a portfolio company or want to in the near future. This is the new normal.

To kick our series off, we will look at how AI changes the landscape by allowing deals to close more quickly, contribute to the earnings, and multiplying exits.

Let’s get to work.

1. Close deals quicker

An LLM’s strength is reviewing unstructured data and consolidating findings that used to take analysts hundreds of hours. Top firms are already using AI for:

Market Intelligence. Synthesize thousands of data points by market and hundreds of zettabytes of global data generated annually.

Deal Sourcing. Scan competitors and ranking acquisition targets with inhuman speed. One report notes that AI can identify 195 relevant companies in the time it takes an analyst to evaluate just one.

Faster Diligence. Reviewing major contracts for key terms to dramatically reduce diligence timelines. Benchmark testing shows productivity gains of 35% to 85% in tasks like competitor analysis and internal financial review, while Apollo reported cutting transaction settlement times by 60%.

Integration. Accelerating system integration by transforming and mapping data between platforms. AI is currently cutting software development and coding time by 50%.

Talent & Productivity. AI adoption is already increasing labor productivity by approximately 30% for firms that have integrated it, turning your best operators into super-users.

It used to take several months and a small army to finish a deal. Now, it can be done in under a month.

Tip: If you are in doubt, go ahead and run a deep research query from any of the big LLMs on your competitors and market. Then, imagine how effective this could be in proprietary databases.

2. Automate value

We are in the beginning phases of actually deploying AI for ROI. But some initial points show how much of an impact it can have.

Metric | AI Impact | Link to Source |

Realized Returns | +20% vs. peers | How AI and Predictive Analytics Are Revolutionizing Private Equity Exit Planning (Enventure) |

Top-Line Growth | +10–15% (via Pricing) | The Private Capital Value Creation Playbook (Private Capital Global) |

Cost-to-Serve | -20% (Supply Chain) | |

OpEx Reduction | -20% to -30% (Maintenance) | The Private Capital Value Creation Playbook (Private Capital Global) |

Engineering Time | -50% (Coding) | |

Legal/Admin Cost | -30% | The evolution of private equity: AI and tech disruption (FinTech Futures) |

And, PE firms are jumping on this by building out centralized teams that smaller organizations would not have the capital to do:

EQT (Motherbrain). A proprietary AI platform that ranks targets and assists portcos in identifying "whitespace" for expansion.

Apollo. Operates an AI Center of Excellence where a mix of partners and engineers vet AI initiatives and "push" them across the portfolio to drive 10–25% revenue increases.

Vista Equity. Recently launched an Internal AI Task Force. Over 80% of their portcos have active AI initiatives, focusing on software development efficiency (reducing coding time by 50%).

NPE (Neuberger Berman) w/ Palantir. Known for NPECT, leveraging Palantir’s Foundry/AIP to create a "Unified Structure" (Databricks/Lakehouse) for portco data.

Hg. Uses "Peer Exchange. "a network effect where portco CTOs share AI "winning" prompts and models to avoid reinventing the wheel.

Expect an industry-wide playbook to be established once a couple major wins have been established.

Tip: Check out our in-depth AI guide for how to get started.

3. Supercharge your exit

The market for non-AI driven scale has been starved. Anecdotal, there is very little capital for non-AI plays forcing the funding market into two lanes: AI fast-tracks and AI potential. This means:

Massive AI valuation split. Series D+ AI startups are seeing median valuations ~230% higher than non-AI peers, so your equity story must clearly prove AI maturity or you sell at a discount.

IPO window (for giants). AI’s capital needs are pushing top platforms toward public markets, making IPOs a real primary exit again for large-cap sponsors.

Wrappers get consolidated. Thin AI apps without proprietary moats will get swallowed in bolt-ons, so wrapper owners should build a platform before pricing power collapses.

Continuation vehicles surge. With traditional exits clogged and holding periods longer, Continuing Vehicles are becoming the default way to extend winners and create LP liquidity. (Later article goes in-depth).

The bottom line is that most companies are still able to instantly gain a premium for simply using AI across the company.

In conclusion

Private Equity will be at the forefront of distributing AI through companies and force any laggards to keep up pace. 2026 will be quite the ride.