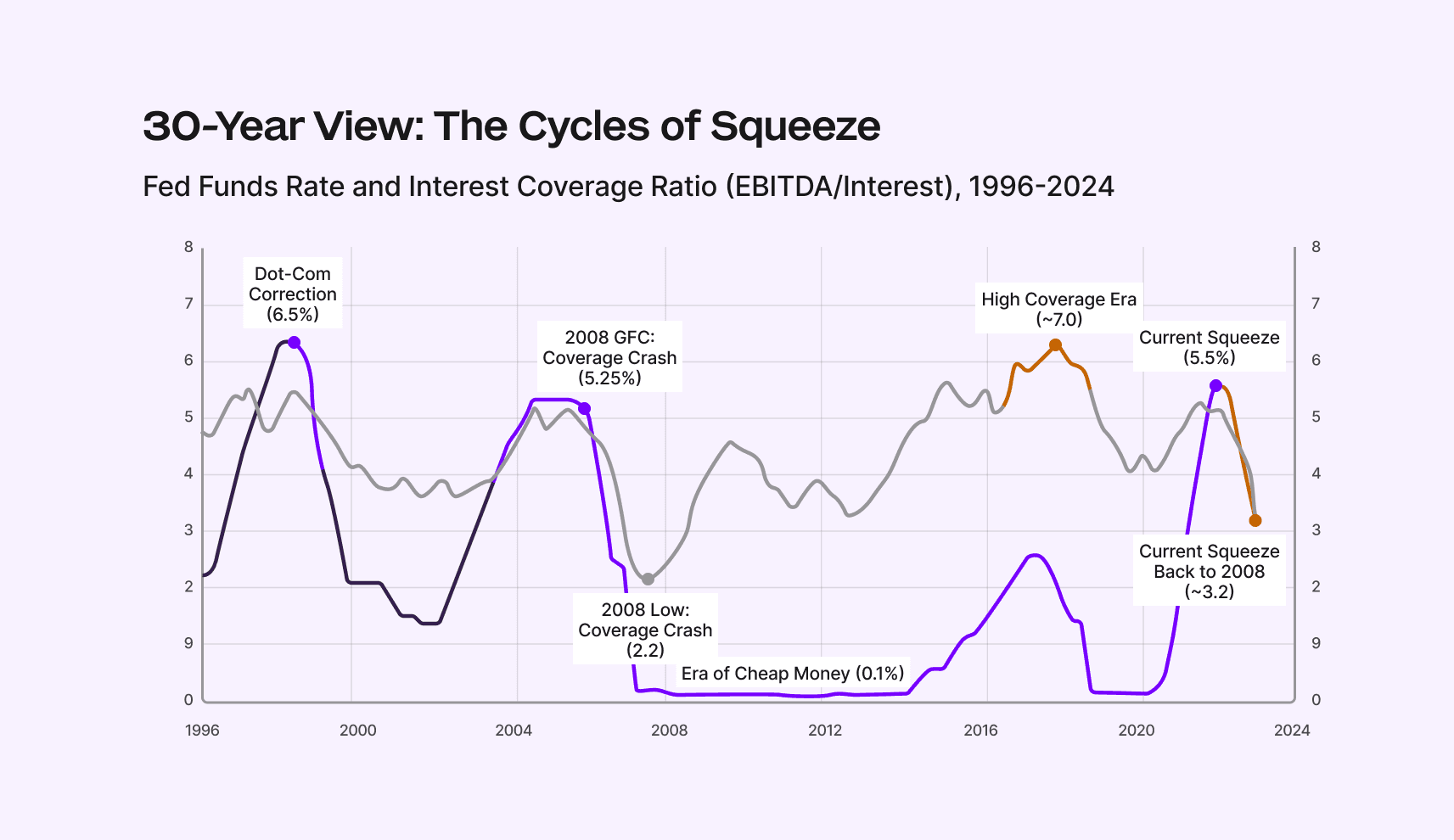

It used to be simple: borrow cheap, buy big, and let the profits (and tax write-offs) pay the bills. For over a decade, private equity ran wild on low interest rates (2009–2020), snapping up companies in leveraged buyouts with confidence that EBITDA would comfortably cover interest payments. And for a while, it did. At one point, average interest coverage hovered near 7x in 2012-2020. The golden age of “Buy company, load up with debt, start sailing by noon.”

We’re not in the age of cheap debt anymore. The market’s saturated, and sky-high rates make the math a lot less forgiving. Tech companies with negative cash flow don’t fit into the model.

But, leverage still matters greatly to most companies. Whether you’re financing growth or making a deal, the balance of debt, equity, free cash flow, and interest payments sets the foundation for the company’s trajectory.

And when it goes wrong? It really goes wrong. Let’s look at a few reminders from the past two decades:

Toys “R” Us (2005 – Bain Capital, KKR & Vornado Realty Trust). This was one of the classic cautionary tales. A $6.6B buyout loaded the toy giant with over $5B in debt, and roughly $400M in annual interest. Combine that with falling sales and e-commerce headwinds, and they never had room to invest or adapt. Chapter 11 came in 2017, and the U.S. stores didn’t make it.

Avaya (2007 – Silver Lake & TPG): PE backed a hardware-to-software pivot, but $6B in debt and $400M+ in annual interest crushed R&D just as the market moved to the cloud. Avaya missed the shift, stalled out, and filed for Chapter 11 twice.

Riverbed (2015 – Thoma Bravo): Bet on hardware dominance didn’t age well. SD-WAN exploded, debt blocked innovation, and Riverbed couldn’t keep up. With revenues tanking and no capital to pivot, it landed in Chapter 11 by 2021.

GoTo / LogMeIn (2020 – Francisco Partners & Elliott) Acquired for $4.3B, the thesis was to ride the remote-work wave with tools like GoToMeeting and LastPass. Instead, they got crushed in the middle: squeezed by "free" (Google Meet) and "better" (Zoom/Teams). The LBO debt left them no financial room to fight a price war. By 2024, the company was forced into a distressed debt exchange to avoid bankruptcy, with the sponsors' equity largely decimated.

It’s important for finance executives to get this right by using free cash flow to pay off the debt, increase the equity value, and deleverage the company over time. Let’s get to work.

1. Know the leverage game.

You need to know the basic leverage mechanics to understand why PE can be incredibly lucrative for the GPs (and thus their incentive). The basics:

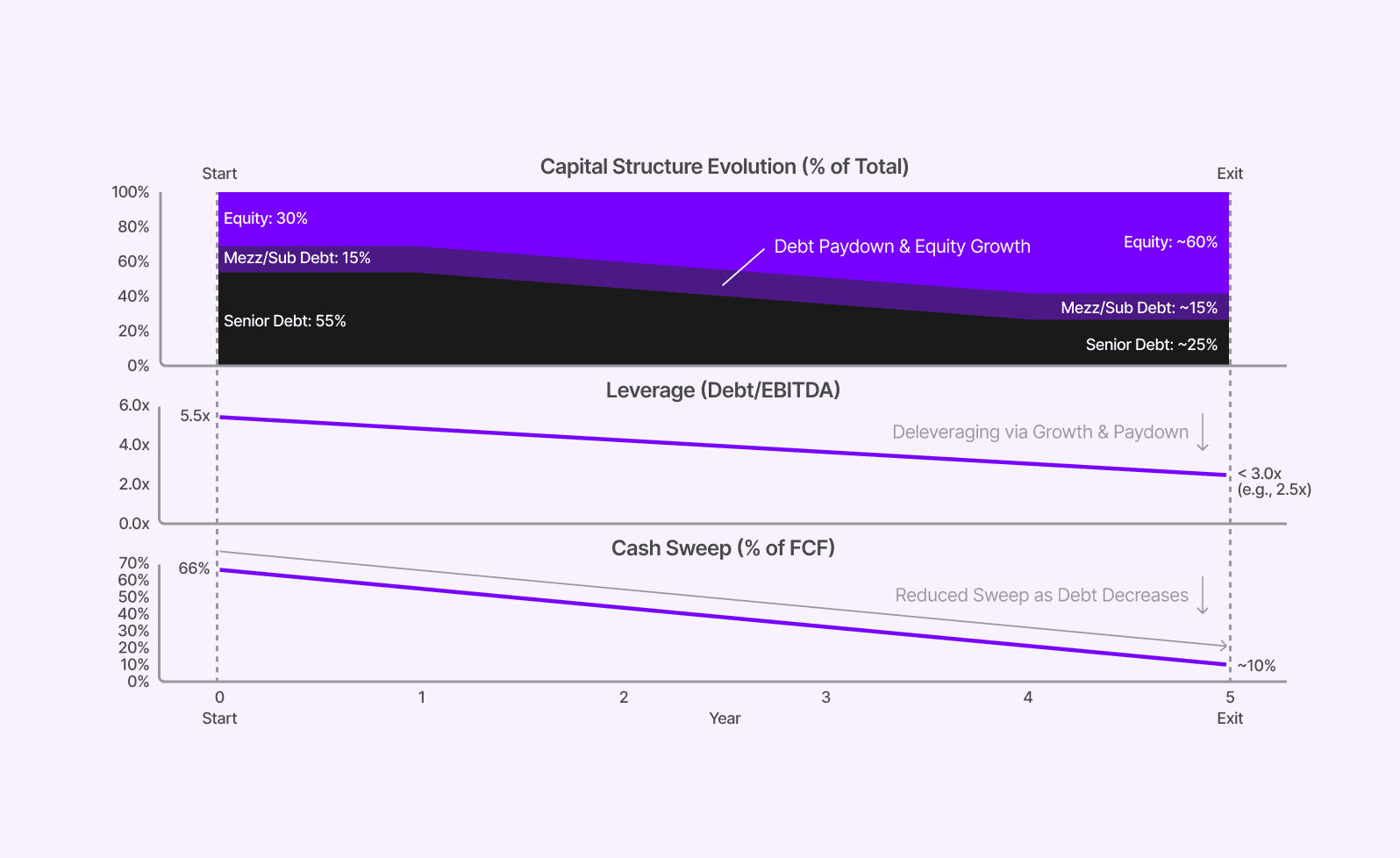

Start with the leveraged buy-out. PE buys a company with their LP’s cash as equity (30/40%) and a loan (60–70%) to cover the rest. The debt will then sit on the company, backed by its assets and cash flows.

Decrease the debt to increase the equity wedge. Over the next 3-5 years, the company increases free cash flow by increasing revenue or decreasing costs, which is then used to pay off debt and interest, increasing the value of the equity.

The exit. At sale, cash comes in, remaining debt gets paid off, and the leftover is net equity proceeds. If EBITDA grew too, you get a double win: deleveraging plus a bigger enterprise value.

The final math.

Buy at $100M with $60M debt / $40M equity.

Over 5 years, EBITDA doubles ($10M → $20M) and debt drops by $30M

Sell for $200M.

Pay off $30M remaining debt

leaving $170M equity proceeds, meaning $130M profit on a $40M check. Leverage magnifies outcome.

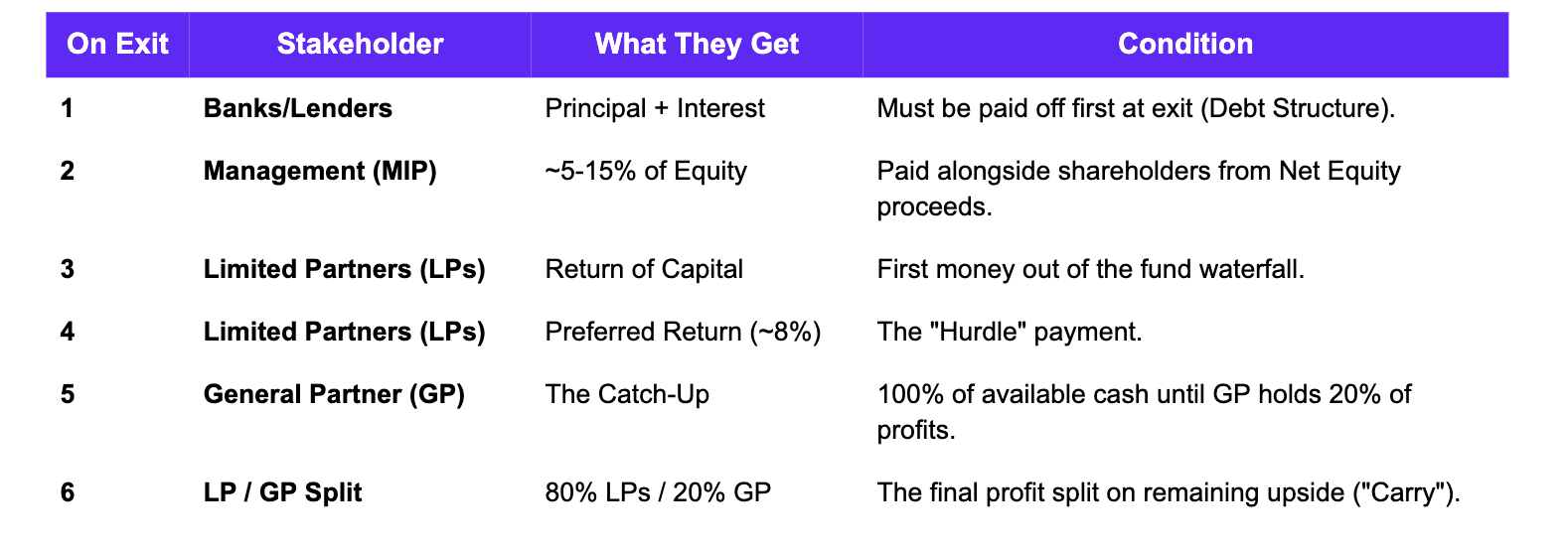

At the end, the profits will be divided up according to the distribution waterfall. Note that in the end, the GPs usually end up putting only 1-2% of their own money in the deal, and stand to gain 20% of the total profit split.

Tip: The finance team needs to make it crystal clear to the management team what they stand to gain in each version of an exit, so the incentives work as intended.

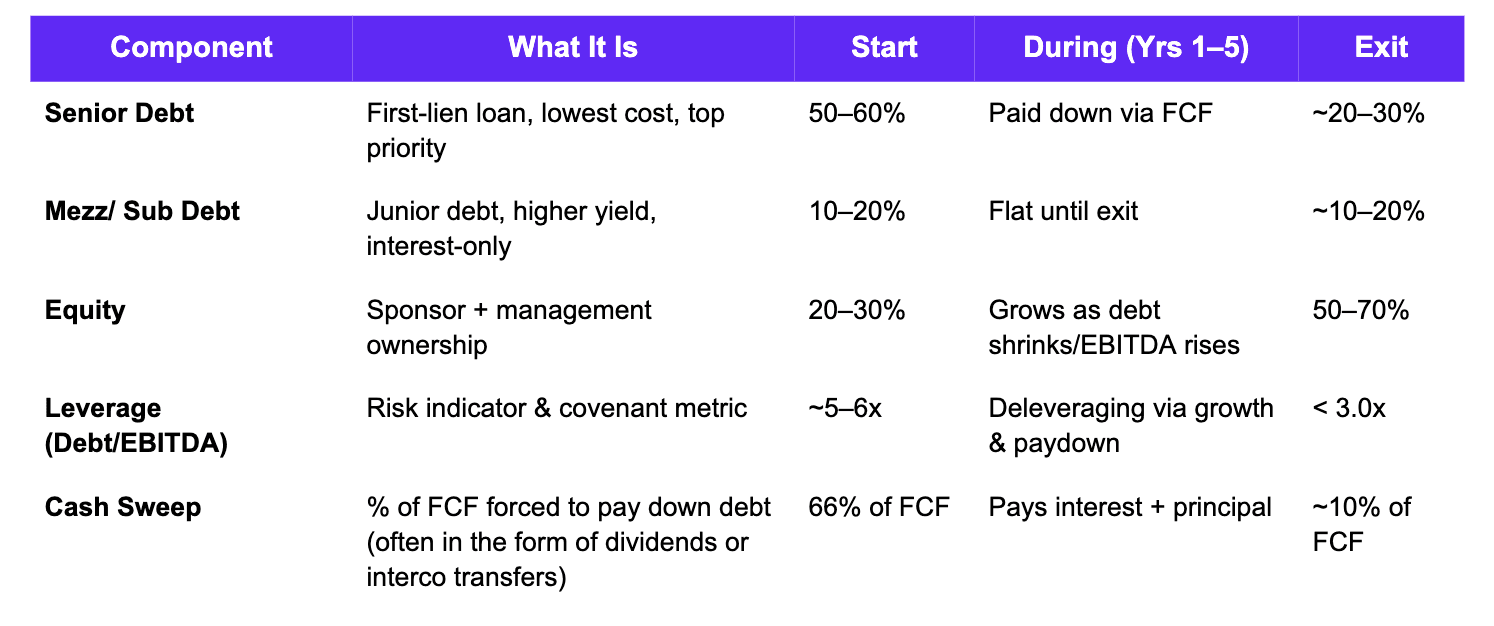

2. Understand the consolidated structure

You may not hold all the debt as a portfolio company (usually held at the HoldCo) but it is there. Upon consolidation, the consolidated capital stack is a hierarchy of risk and priority which looks like:

Paying back the debt structure while making radical effectiveness improvements is a daily operational constraint you will need to navigate.

Tip: Tech does not emphasize traditional loans as much, preferring the less cash intensive venture debt.

3. Start by modeling future cash needs (balance sheet)

Create a strong model to stress test cash and foresee any future issues. That means sussing out:

Cash Flow Timing. Review in depth billings, payables, future contracts and seasonality to get a handle on cash in / out.

Model debt repayments. Map debt paydowns strictly to FCF. Forecasting repayments in quarters where working capital absorbs cash is a modeling mistake.

Interest Rate Sensitivity. Assume rates stay high. Test your model against worst-case rate environments to make sure you’re not betting the platform on Fed policy.

Ending Value. Exit equity = Projected enterprise value – remaining debt. If deleveraging doesn’t widen the MoM wedge, you’re taking leverage risk without the upside.

Your capital projection is the risk playbook. Test it ruthlessly, and make sure it shows a path to both debt service and equity growth.

Tip: Be pro-active about the trade-offs that cash flow entails. For example, if marketing reductions free up cash now but reduce the possible exit value by 10%, make the point to your operating partner.

4. Track coverage compliance and ratios

You need to track all of the debt coverage compliance ratios thoroughly. You will often have to report these to the lender directly. What to look out for:

Debt/EBITDA or debt/ARR Leverage. This is the ceiling. Keep it under 4.0x–5.0x in this rate environment.

Interest Coverage Ratio. EBIT must cover interest comfortably before you ever worry about net income. Target >2.5x. Many peers are stuck at 2.4x and struggling

Fixed Charge Coverage. Include CapEx and taxes. Green > 1.5, Red < 2.0.

Gross retention floors. Green > 90%, Red < 85%. If retention drops, the bank views your collateral as "dissolving" and may recall the loan.

Scoreboard Visualization. Build a Red/Yellow/Green dashboard for covenants and include it in every board pack.

If you get near violating any covenants, you will need to take immediate action by raising funds elsewhere, getting the bank to waive the covenants, or you will risk a recall of the debt immediately.

Tip: Of course, if you still aren’t making money these metrics are nearly useless. So, make sure you have a minimum cash runway of at least 12 months.

5. Consider refinancing

Refinancing enables growth for acquisitions, new products, revenue acceleration. Use it strategically when the window opens.

Amend and Extend. Don’t wait for the cliff. Get ahead of the $300B in loans maturing through 2025 by negotiating early.

Opportunistic Repricing. When spreads tighten (like the 100 bps drop in 2024) lock in the lower rates to free up cash flow.

Private Credit Pivot. When banks pull back, direct lenders can step in with speed and flexibility. It might cost more but the extra time or immediacy of the funds might be worth it.

Equity Injection. Sometimes you have to trade dilution for survival. This is a last resort as it immediately decreases the value to the PE fund itself.

If you see the strong business case, refinance proactively to maintain the best deal and charge growth.

In Conclusion

Finance leadership has to be just as disciplined as the deal team to run the capital stack like an operating system. You want to protect liquidity, de-lever early, stay away from covenant breaches, and explore alternative financing to growth.