Private Equity gives finance leaders the chance to shine under pressure. It’s a world driven by effectiveness, fixed deadlines, balance sheets, tax optimization, skin in the game, and yes, even making MORs sexy. It is also a world AI is set to supercharge.

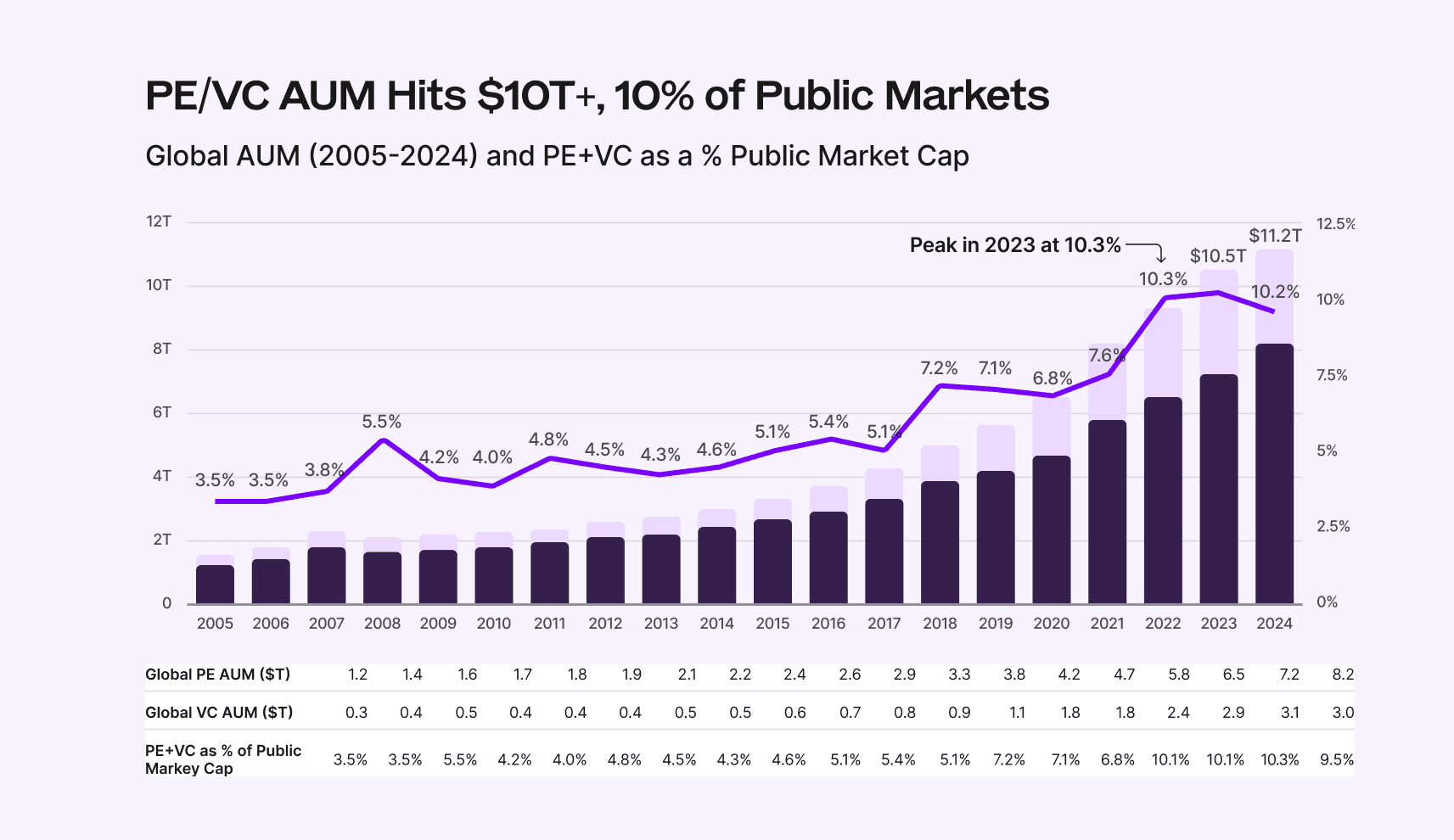

PE firms manage three times the assets of venture capital, and together they’ve grown nearly fourfold over the past 20 years. PE invests with a thesis, and their wins can make great headlines:

Skype. Silver Lake turned the B2C calling company into a sale to Microsoft by resolving a major IP issue with the founders and shifting to an enterprise grade software. In just 18 months, they turned $1.9B into $8.5B for a 3.1x MOIC and 70%+ IRR. (Reuters)

Visma. Hg Capital realized Visma’s customers' stickiness and transitioned their legacy to SaaS pricing leading to increased valuation multiples. They then added over 300 bolt-on acquisitions in the same formula for a 35x MOIC and ~30% IRR over 20 years. (Yahoo Finance)

Aldevron. EQT acquired a majority stake in this plasmid DNA manufacturer and aggressively scaled its production capacity just before the global mRNA boom. By positioning the company as the critical "pick-and-shovel" supplier for gene therapies and COVID-19 vaccines (like Moderna’s), they sold the asset to Danaher for $9.6 billion (MOIC of 3x) less than two years later. (PE Insights)

Formula 1. CVC centralized F1’s global media monopoly and made cities pay for the prestige of hosting races. Ten years later, they exited with a 4.5x MOIC and a “most profitable trade in history” reputation. (MIT)

And, as we discussed in the last article. The new play is the AI roll-up. For finance executives at a portfolio company, PE types of wins offer substantial upsides:

Management incentive plan. You could >3x the value of your equity in just four years.

Strategy alignment. Finance takes the lead in driving operational and strategic optimizations.

Career boost. Succeeding in a PE-backed role opens doors and there’s strong demand across the portfolio.

The trade-off? High pressure. Aggressive deadlines. Constant scrutiny on the numbers. Compared to other funding models, Private Equity runs the tightest ship:

Ownership | Primary Focus | Time | Financial Priorities |

Private Equity | Maximize ROI via sale (MOIC/IRR); drive cash flow & KPIs | 3–7 years | Aggressive value creation, cost efficiency, debt paydown |

Venture Capital | Rapid growth, user/revenue scale; hit next funding/liquidity event | 5–10 years | High burn accepted; focus on ARR, PMF, user growth |

Public Company | Long-term shareholder value, earnings stability | Indefinite | Predictable growth, margins, dividends, compliance |

Founder-Owned | Founder vision & control; balanced growth | Flexible / generational | Cash flow focus, simple controls, tax efficiency |

We will continue our deep dive into PE by examining the firm’s objectives and the changes they bring to finance executives at portfolio companies.

Let’s get to work.

1. Understand the PE objective

You are aiming for a sale within five years that optimizes their MOIC (multiple on invested capital). This means knowing the:

Importance of MOIC and IRR. If a PE firm invests $100m and returns $300m, that is an MOIC of 3. Now, what matters is the time frame. If that $300m returns:

In 2 years: IRR of 73%. Rockstar results.

In 5 years: IRR of 25%. Top tier results, but depends on risk profile.

In 10 years: IRR of 12%. Not great. Barely above public equities with a lot more risk.

Pressure of DPI. The money actually returned to investors (LPs) after management fees/etc. This is how LPs evaluate their investment and thus the PE firm’s reputation (>2.0 good performance).

Purchase thesis. You can increase your value mainly through: multiple expansion on exit, EBITDA expansion (through margin and revenue growth), deleveraging (debt paydown).

Acquisition strategy. The PE fund will have a lot of money to finance acquisitions, either vertically or horizontally, standard playbooks for value increase.

Exit strategy: Is the plan a strategic acquisition? An IPO? A continuation? Knowing the dream endstate will help you guide operations.

By thoroughly understanding these metrics and goals, you will align yourself with the new owners.

Tip: With high interest rates, and relatively unmoving exit multiples, the most popular PE plays are primarily around metric improvement and EBITDA expansion

2. Know the players

The players in a PE play:

The LPs (limited partners). They provide 99% of the capital to the PE firm but have zero operational control. They put pressure on the general partners to deliver real returns (cash back), not just IRR.

The GPs (general partners). They run the PE firm and make the deals. They are driven by their carried interest in each deal itself, in addition to management fees.

The Operating Partners / shadow management. The functional SWAT team parachuted in to bridge the gap between the deal team’s financial theory and your operational reality. They are the sparring partners to consult with on strategy and the technical auditors of the strategy.

Company management. A mix of new talent and top performers will be in charge of leading the company from the inside.

Generally, each of these parties is united by a chase of MOIC/IRR through equity, but there is the occasional cross-motive.

Tip: Pro-actively work with the Shadow-CFO by inviting them to stress-test models and results privately before they go to the full board. Set a clear boundary that they go through you first before your team.

3. Translate the deal into action

Once a deal is done, the stopwatch starts. Results are expected quickly.

Review diligence findings. Convert the PE’s diligence opportunities into one-line goals with defined EBITDA impacts to ensure every idea has an owner and a goal.

Build a value creation plan. Map out your needed wins in a clear document that ties back to the GL so you can track easily.

Model out your debt servicing. Model the Debt Service Coverage Ratio (DSCR) constantly (particularly at the beginning) to track capacity and protect covenant headroom during seasonal EBITDA lows.

Nail the iteration process. Build quick, rolling reforecasts that focus on driving input metrics to action.

Note that you don’t want to reinvent the wheel. The deal was done on the basis of a premise. It's your job to start executing.

Tip: Timebound the turnaround process with a 100-day value creation plan - to be discussed in a further article.

4. Get into the reporting cadence

Your job is to create a cadence that surfaces issues early, assigns owners, and forces decisions with clean data to drive towards a successful exit. To do so:

Define decision rights and escalation paths. Document who owns each KPI, who can approve spend, and what triggers an escalation (e.g., covenant headroom, churn spikes, missed bookings).

Run the Monthly Operating Review (MOR) like a management working session. Hold a monthly deep dive with the sponsor’s operating partner. Go line by line.

Install a weekly performance cadence. A short weekly review (30–60 minutes) with your team on the few leading indicators that move EBITDA/cash.

Publish a hard close + reporting calendar. Enforce a “90% close” in one day, with same-day variance commentary and owners. Final close follows, but leadership operates on fresh signals.

Institute flash reporting. Deliver an early-month “flash” view (Day 1) that is directionally accurate and action-oriented. The goal is speed to decisions, not perfect accrual precision.

Make the 13-week cash flow non-negotiable. Keep it continuously updated and within a percentage point so you can spot cash crunches before they become lender conversations.

Tie reporting to action. Use input metrics (a DuPont-style driver tree where relevant) so the team can see exactly which levers change outcomes and what they must do next.

To make such rapid change, you need to be looking over the numbers so that you maximize your chances to try new things.

Tip: Debt covenants take on a new emphasis. Track covenant headroom and balance sheet ratios as part of the standard operating rhythm.

5. Automate your setup

You can’t be chasing numbers back and forth while iterating at this pace. You need a system that works. That means:

Standardize reporting systems. You want to provide the same format of numbers that you use internally externally so you don’t have to constantly re-work the same numbers.

System of live data. In reality, you want to be closing much more often than every month. Ideally, you want numbers daily. Daily numbers give you 30x chances of incremental change vs. monthly.

Create a single source of truth. This needs to have drill-downs and roll-ups from various sources to make the MORs useful.

Multi-entity consolidations. You need to see across all your entities, but it becomes critical when you are looking into the classic roll-up or buy-and-build that incorporates others’ systems in days.

You need to drive this quickly so that all other teams can be focusing on driving effectiveness within their operations.

Tip: A hot take, but don’t waste time re-tooling your ERP. Put the data layer on top to gather all the information and transform it.

6. Control operations tightly

You are going to go through a period of quick change. It will take a while to get everyone on ‘message,’ but the easiest way to do that is to take firm control of the finances to lead the change.

Budget quickly and hold people accountable. Move fast.

Real-time cost approvals. Require a project code on every direct expense as a mandatory requirement to tie back to the value creation plan.

Budget with buffer. Budget a 5–10% “Flex Fund” that is held back and only released for pre-ranked investments when revenue targets are hit.

Pricing guardrails. Perform price waterfall analysis to identify leakage and set hard floors for discounting that require executive approval.

Working capital. Track the Cash Conversion Cycle relentlessly and link target improvements directly to your liquidity runway and debt paydown schedule.

Obviously there is much more to do here, but getting these done quickly will help the company adjust to the new pace.

Tip: Don’t forget compliance. The last thing you want in this process is lawsuits, product recalls, or reputational issues that can take years to resolve and delay/suppress any sale.

In conclusion

Private equity focuses relentlessly on execution. If you deliver on the plan you're building toward a defined liquidity event. So, in 5-7 years you can have a meaningful exit that can generate substantial wealth.