It’s been one year since we launched FP&A from Trenches. Over 15k finance leaders have read our 49 articles, compiled into 7 guides ranging from being a Strategic CFO, to Fundraising, Analytic Deep Dives, Budgeting, and more. Written by finance executives for finance executives.

What to expect in the near term

Our 2026 Book of Finance. Yes, we have updated and turned our work into a book. It's already out!

An increase in original research, taking macro trends and turning them into answers for those in the messy world of scaling.

A new guide for private equity backed and wanting-to-be-backed companies coming in January.

Thank you for your time and we look forward to the coming year.

Without further ado, here are our top five articles from 2025.

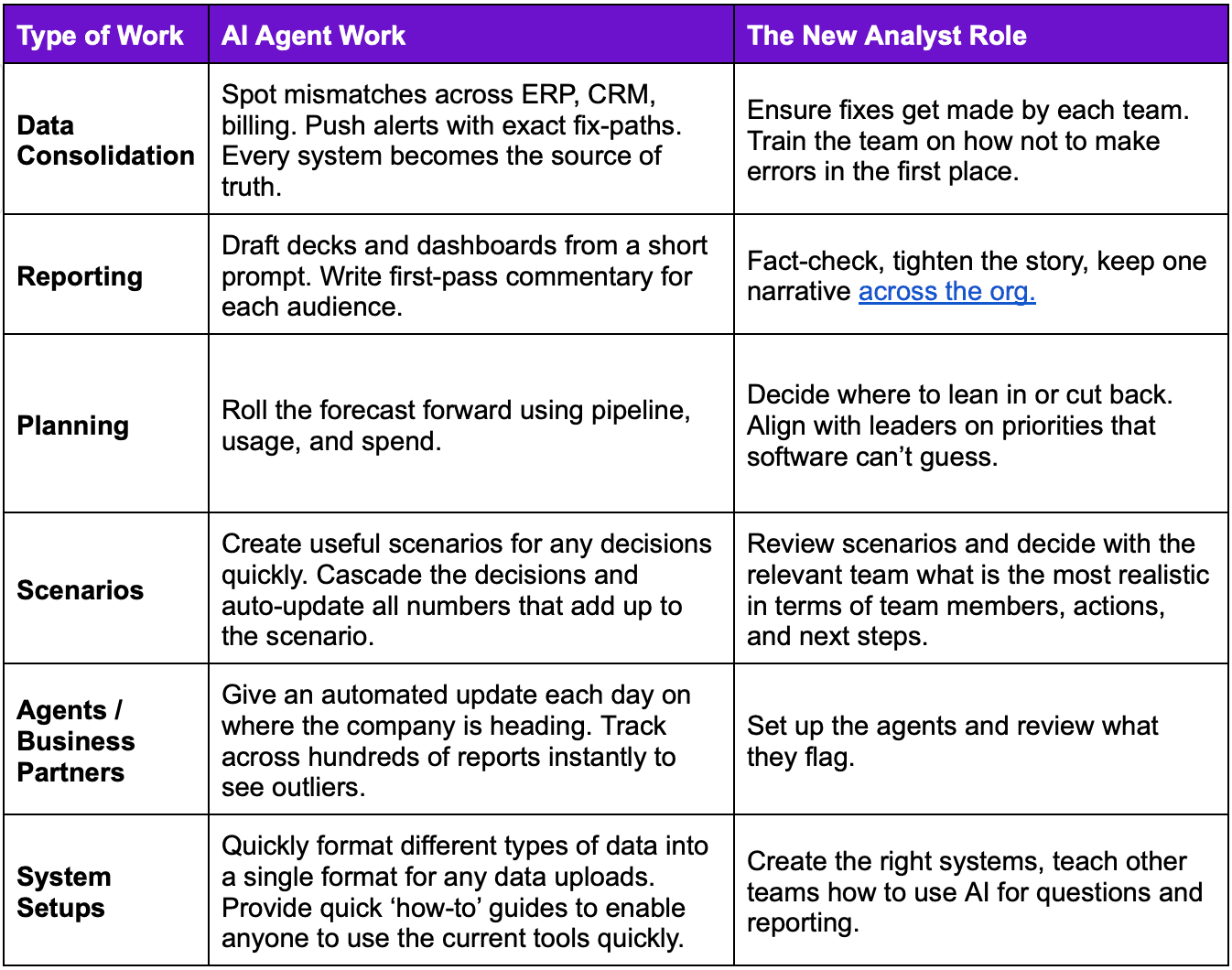

1. Rebuilding Your FP&A Team for the Age of AI Agents

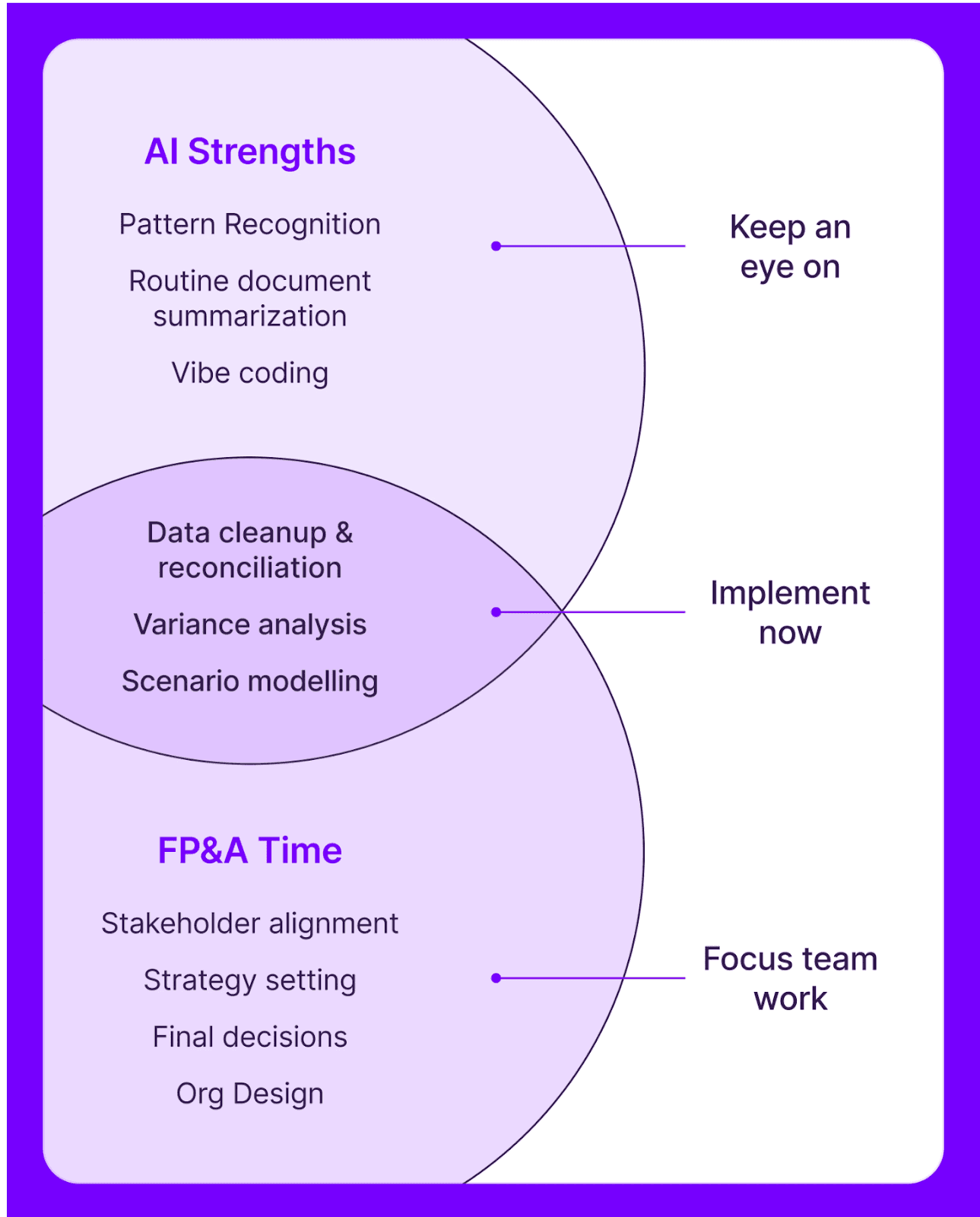

AI agents are here. They won’t do everything, but they are already doing some things very well. We discuss how to lay out a blueprint for the new FP&A teams you should hire to work alongside agents. This requires new hiring strategies for a team that will build and scale your future rollouts.

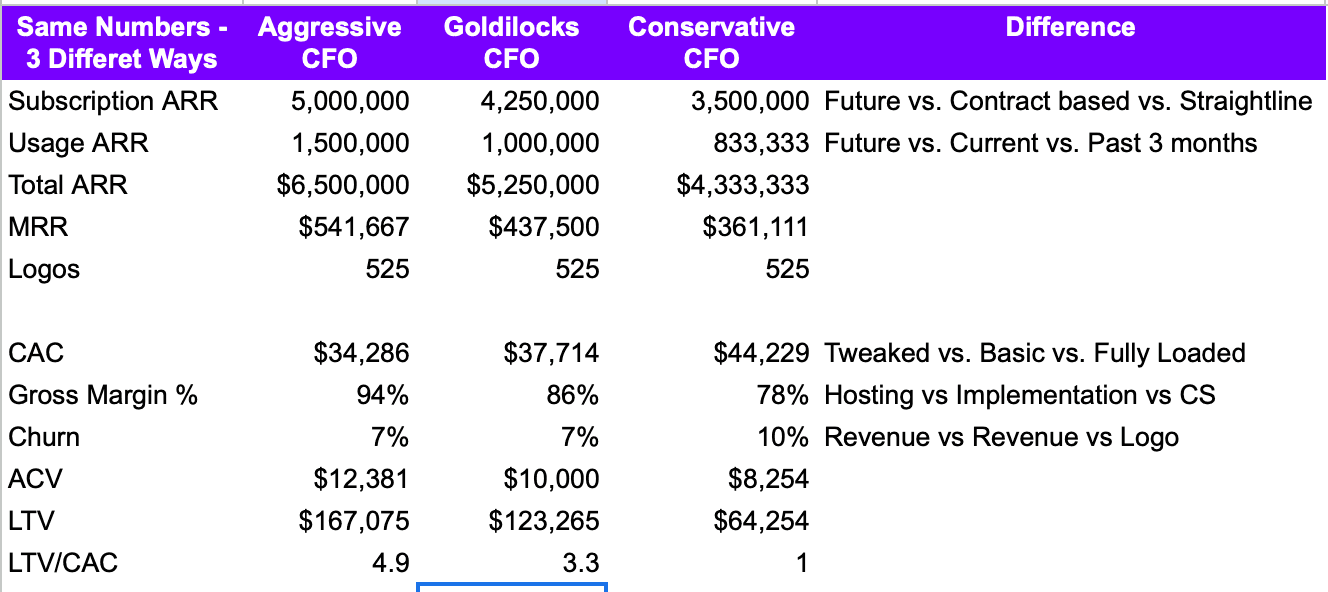

2. SaaS Metrics: Small Definition Changes, Massive Consequences

I once saw a VC poll asking how portfolio companies define ARR and there were five answer choices. Each got over 10% of the votes. Each could lead to an ARR difference of 30-40%. I still think about that when imagining a VC trying to compare company results…

To help you navigate this, we’ve compiled the most common definitions of each metric, organized by risk level, along with their key pros and cons.

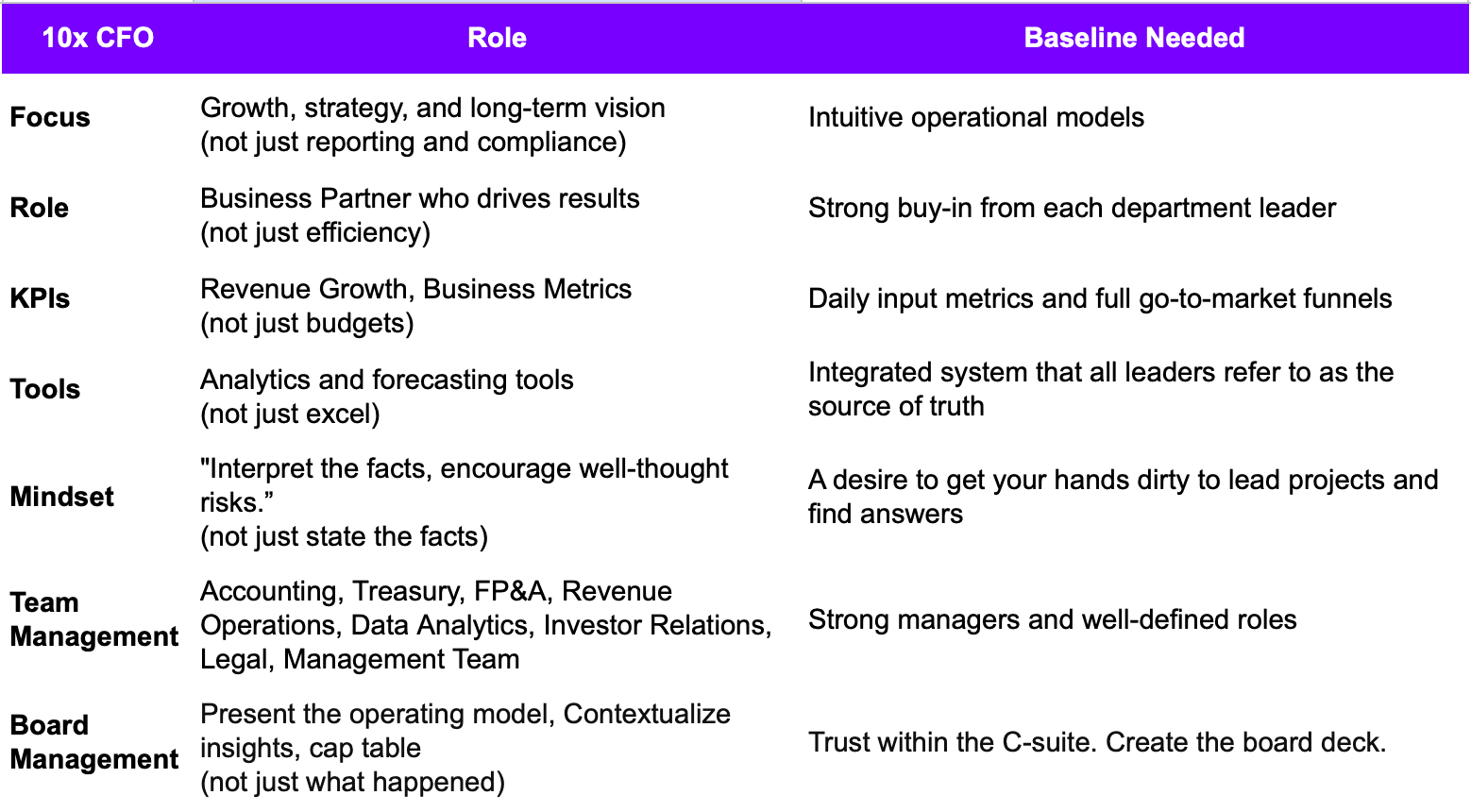

3. Becoming a Strategic CFO: From Reporting to Orchestrating

Every startup needs to have a leader who advises on strategy and decisions using company-wide data. And yes, it is clear that the leader should be Finance with its accountability mandate and data ownership. But to take this role, you will need to earn the company’s trust. It starts with the basics: control the finances, focus on what matters, drive the company to results, run the MBR process, stay ahead of market trends, leave your ego at the door, and lean into your skill set.

4. The Real FP&A AI Dream: Augment, Don’t Replace

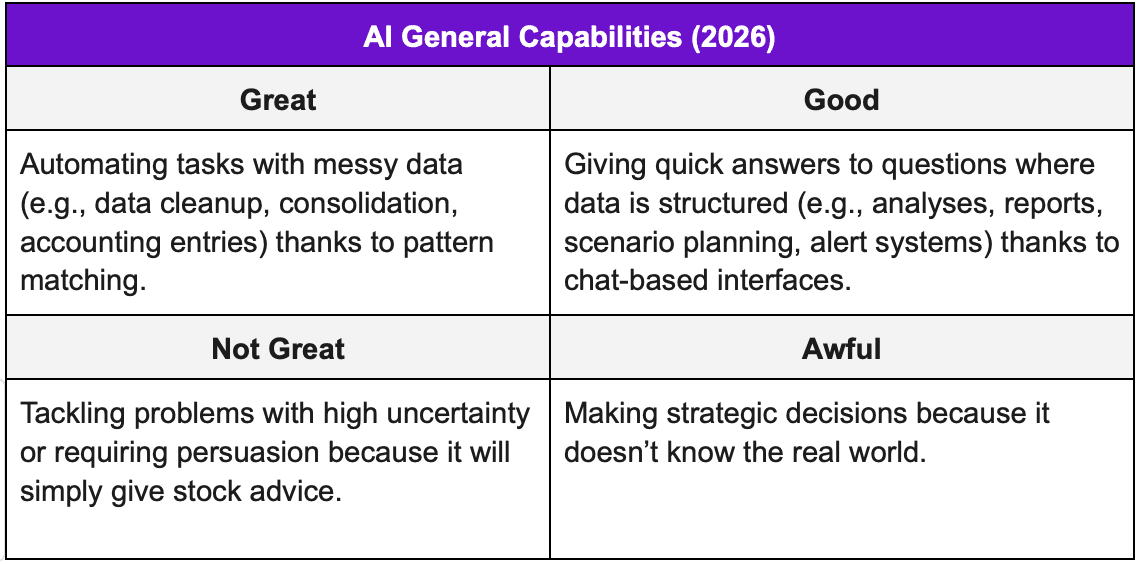

When finance embraced double-entry accounting, ERPs, and Excel, the function grew into the strategic powerhouse it is today. And the teams that embraced these tools early moved faster and achieved success more quickly. So, paradoxically, AI is both the most underhyped and overhyped technology of our time. We present a framework for where to roll out AI now..

5. AI Discipline Is the Real Advantage and the Gap Is Growing

There was Hershey Foods’ infamous 1999 ERP and CRM go-live disaster over Halloween resulting in over $100 million of undelivered inventory. Cadbury Schweppes’ 2006 ERP rollout led to a $12 million chocolate inventory pile-up from bad order projections. Mission Produce’s ERP launch? It resulted in a complete loss of visibility into how their avocados were ripening, costing millions in spoiled fruit and the indignity of having to buy the fruit from competitors.

But mistaken roll-outs aren’t just chocolate and avocados. In this article, we go through actually implementing the current AI tools.

In Conclusion…

These top FP&A articles of 2025 highlight a year defined by smarter metrics, stronger teams, and the rapid rise of AI as a true strategic enabler for finance.

Together, they paint a clear picture of where the function is headed: toward deeper partnership with the business, more disciplined decision-making, and a future where technology amplifies human insight. As we move into 2026, these lessons offer a concise roadmap for any finance team ready to elevate its impact.